The next Texas Legislature began on January 14, 2025, giving state-level policymakers their next best opportunity to revisit property tax relief and property tax reform. The former refers to lowering tax bills while the latter speaks to keeping them down.

This column concerns itself with the latter, tax reform, and offers several suggestions to protect future tax relief from opportunistic local governments.

When considering tax reform, there are 3 major areas to take into account. The first is the maintenance and operations (M&O) tax, which, as the name suggests, is “used primarily to pay for the day-to-day functions of government.” This most often funds things like salaries, supplies, and services. Second, there is the interest and sinking (I&S) tax, which is used “to pay bonds, including interest, to finance capital projects such as buildings, facilities or other infrastructure.” Think government debt. Lastly, there is a category of indirect reforms that, if implemented, could have a profound impact on the property tax system as a whole, as one might imagine were a local expenditure limit ever enacted.

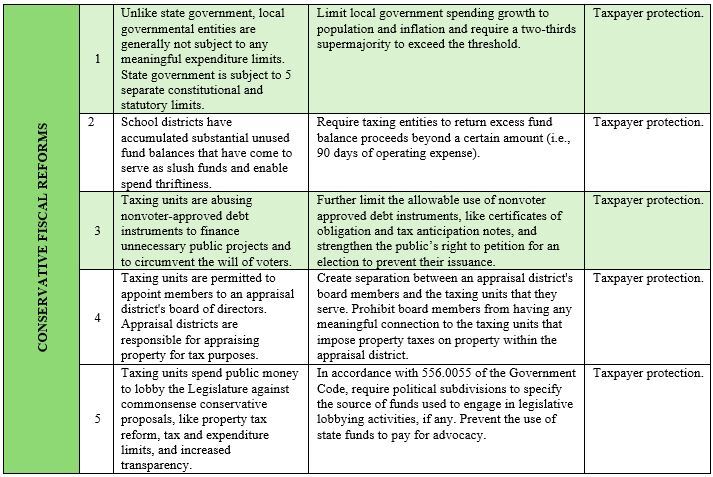

This brief commentary is concerned with the set of other reforms and proposes 5 ways to revamp the current system in a taxpayer-friendly way. Reforms of this type strive toward establishing stronger taxpayer protections, irrespective of the M&O- and I&S-specific changes that are needed.

- Limit local government spending growth to population and inflation and require a two-thirds supermajority to exceed the threshold.

- Require taxing entities to return excess fund balance proceeds beyond a certain amount (i.e., 90 days of operating expense).

- Further limit the allowable use of nonvoter approved debt instruments, like certificates of obligation and tax anticipation notes, and strengthen the public’s right to petition for an election to prevent their issuance.

- Create separation between an appraisal district’s board members and the taxing units that they serve. Prohibit board members from having any meaningful connection to the taxing units that impose property taxes on property within the appraisal district.

- In accordance with 556.0055 of the Government Code, require political subdivisions to specify the source of funds used to engage in legislative lobbying activities, if any. Prevent the use of state funds to pay for advocacy.