TPPF Conservative Texas Budget: $246.8 Billion

Texas Budget: $245.3 Billion

Overview

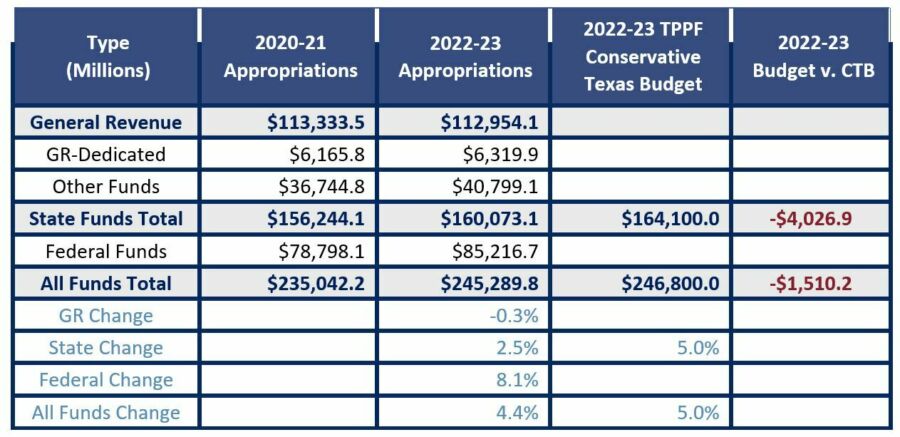

This table provides a comparison of initial appropriations for the 2020–21 budget from the Legislative Budget Board’s (LBB) Fiscal Size-Up and for the 2022–23 budget. We compare the 2022–23 budget with the Foundation’s Conservative Texas Budget (CTB) limits based on a 5% increase in population growth plus inflation.

Exclusions

In the table above, we exclude the following amounts:

For the 2020–21 budget:

- $3 billion in mostly federal funds for Hurricane Harvey recovery expenses.

- $5 billion in general revenue (GR) funds for a 7-cent tax rate compression of school district M&O property taxes in HB 3 from the 2019 session.

For the 2022–23 budget:

- $6.1 billion in GR funds during the 2021 regular session to maintain property tax relief provided in 2019—necessary to avoid a 7-cent rate hike and more spending.

- $100 million in GR funds for property tax relief for first-time homesteads (SB 8) during the second special session.

- $13.3 billion in one-time federal funds from the American Rescue Plan Act of 2021. We excluded this amount for transparency—as it was appropriately kept separate in Article XII of the budget—and not to inflate the budget as happened to public education after the American Recovery and Reinvestment Act of 2009. If this funding becomes recurrent, we will add it in the next biennial budget.

Results

Although the Legislature had substantially more revenue available to appropriate throughout the regular and special sessions, the 2022–23 Texas budget is well below the CTB limits in state funds and all funds and leaves more than $12 billion in the rainy day fund. After excluding the $6.1 billion to stop a massive property tax hike and the $100 million to provide some Texans with property tax relief, as these amounts do not grow government, general revenue funds decline by 0.3% and state funds are up by 2.5%. All funds, which is the full footprint of the taxpayer’s burden to fund state government appropriations, is up 4.4% to $245.3 billion—0.6 percentage point or $1.5 billion lower than population growth plus inflation, thereby leaving unappropriated revenue on the table.

Historical Comparison

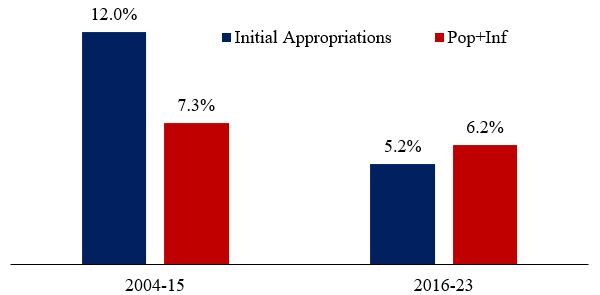

The following figure shows that the growth of initial appropriations, on average, has been well below the average taxpayer’s ability to pay for them over the last four budgets, as compared with the prior six budgets. The last four budgets were passed after the Foundation created the CTB in 2015.

Texas’s Budget Growth Has Slowed Since Creation of the CTB in 2015

Note: Data from Fiscal Size-Up, Legislative Budget Board, n.d. (https://www.lbb.state.tx.us/FSU.aspx) and authors’ calculations of average biennial growth.

Outcome

The Texas Legislature’s practice of fiscal restraint while meeting the needs of the state is good news for Texans. Additionally, the 87th Legislature passed SB 1336, which put into statute much of the fiscal rule used in the CTB. This change strengthened the state’s spending limit by expanding the base from general revenue not dedicated by the Texas Constitution to all general revenue funds (50% of the budget), by changing the limit from personal income growth to population growth times inflation—calculated as (1+pop)*(1+inf)—and by increasing the voting threshold to exceed the limit from a simple majority vote to a supermajority three-fifths vote in each chamber. After the Foundation has worked toward this statutory change for multiple sessions, this is a huge feat that will have long-lasting benefits to Texans.

Recommendation

We encourage Gov. Greg Abbott, Lt. Gov. Dan Patrick, Speaker Dade Phelan, and the Legislature to build on these policy wins and more by providing paths for more fiscal gains—such as eliminating property taxes and imposing local spending limitations and responsibly appropriating all federal funds—so that Texans have even more opportunities to prosper.