KEY POINTS

- The summer situation for the Texas grid is actually better than advertised, but winters are becoming a bigger and bigger problem with no clear solution on the horizon.

- Legislators took some baby steps with HB 1500 to eliminate the last vestiges of state subsidies for unreliable electricity and move toward real market reform.

- The PUC must follow through on the reforms initiated by HB 1500 and make ALL variable generators pay for backup power when they do not perform. This is the only way to ensure a reliable grid without putting customers on the hook for endless reliability costs.

At a press conference on May 3, Public Utility Commission of Texas Chairman Peter Lake offered reassurances on the reliability of the Texas grid for the upcoming summer while also issuing what seemed to be a dire warning about the future state of the grid.

“The Texas grid faces a new reality. Data shows that for the first time, the peak demand for power this summer will exceed the amount we can generate from dispatchable power, and we will be relying on renewables to keep the lights on,” Chairman Lake said.

That peak demand, nearly 82 gigawatts (GW), is already forecast to be reached on Tuesday, with the hottest part of the summer still to come. ERCOT has been over-forecasting demand over the past week, so that number may not be reached, and the grid will be fine because there is enough wind and sun to cover the extra demand.

However, in light of these dire warnings, many Texans are wondering what the future holds.

Not a New Reality for Summer

First, the reality Lake is describing is not actually new. Summer electric demand began exceeding the output of reliable generators in 2018, following the early retirement of several large coal and gas power plants. While Lake is referring to the installed capacity of dispatchable gas, coal, and nuclear power plants in Texas, what those power plants are able to generate in practice is less than their theoretical capacity. Summer 2018 was the first time there was a gap between peak demand and the actual output of dispatchable generators, and that gap has been growing every year since.

In fact, 2019 was the tightest summer the Texas grid has experienced in recent memory. But since it was before the disastrous winter storm of February 2021, no one heard about it. In August 2019, ERCOT issued two Level 1 emergency alerts, meaning that the grid was relying on emergency resources and was only the loss of a couple power plants or a big dip in wind output away from rolling outages.

In July 2020, we wrote that ERCOT’s rosy forecasts of growing reserve margins were unreliable because the low-end output of wind and solar was far less than the average values being used in those forecasts. Little did we know that we would face a grid disaster the next winter and not the next summer. In a rapid about-face since that disaster, Texas regulators have been agreeing with us that relying on wind and solar to meet peak demand is a risky business.

Fortunately for the grid, but not for Texas, growth in summer electricity demand was slowed by the COVID-19 pandemic. At the same time, the amount of solar capacity in ERCOT exploded after 2019, providing extra cushion to balance out low wind output during the hottest summer days. Despite some hot summers, ERCOT has not had to issue an emergency alert during the summer since 2019.

Winter is Now a Bigger Problem

However, a turning point has been reached, and it is not the turning point that Lake is talking about. What’s happening is that the Texas grid is moving toward a situation where the winter period, not the summer period, will see the greatest likelihood of electricity shortages, even after the winter resiliency measures enacted after February 2021 are fully implemented.

Let me explain why.

First, overall demand is recovering to the pre-COVID growth trend and may accelerate above that trend according to ERCOT’s latest forecasts. Not only that, but winter demand is growing faster than summer demand, and winter demand is highly variable because there is a lot of uncertainty in how cold it will get during Texas winters. The winter storm that hit Texas last Christmas saw demand reach nearly 74 GW, the same threshold that was first crossed in the summer in 2018 and only 6 GW short of the peak summer demand in 2022. This level of demand was reached despite the fact that statewide temperatures were almost 10 degrees warmer than in February 2021.

Second, all the solar being built in ERCOT right now cannot be counted on to produce anything during the peak winter hours. Winter demand peaks at around 8 a.m. and 8 p.m., just before and after the sun rises and sets and during the times when people are at home running their heaters the most. While ERCOT’s forecast of average solar output —remember what I said above about averages—is 14% of its installed capacity, the peak demand hours last December were, as you probably guessed, 8 p.m. with no solar and 8 a.m. with only a bit of sun at the tail end of the hour. It is also more often cloudy in the winter than it is in the summer.

What that means is that the periods of highest net load—which is demand minus wind minus solar—will be more frequent in the winter than in the summer going forward. That net load must be equaled by the amount of dispatchable capacity on the system in order to avoid outages, which means that winter, not summer, will now be the time when the ERCOT grid is most stressed.

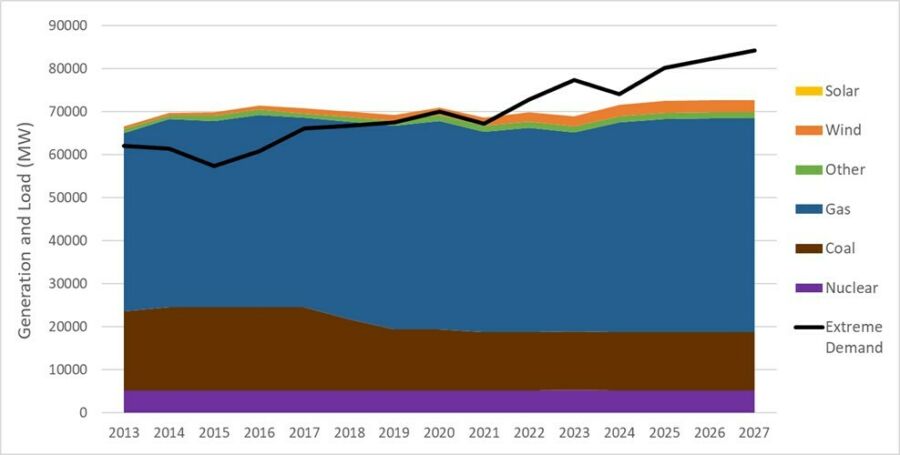

The plot below shows that Texas is already in a situation where extreme demand, similar to what was experienced last Christmas, can easily exceed the grid’s ability to meet that demand if the wind and sun don’t show up enough. The risk of outages will only get worse going forward because the main resource being added to the grid is solar, which will help in the summer but will likely not produce anything during the peak winter hours.

Forecast Winter Peak Demand and Generation with Low Wind/Solar Output

What’s Next

Against this backdrop, the Texas Legislature just wrapped up its regular session, and the PUC is deep into a multi-year discussion of different market reforms. What are our leaders doing to meet this looming challenge?

So far, the answer is not much, but the door is open for more to be done.

The first order of business is to correct the distorted investment flows in the Texas market created by the federal subsidies for wind and solar. Over $80 billion in private capital and $20 billion in federal and state incentives have supported the massive buildout of wind and solar infrastructure in ERCOT. That infrastructure produced only 10% of the state’s electricity during Winter Storm Uri, roughly the same amount of electricity as the 5 GW of nuclear generation in operation at the time. Even directing $25 billion of that $100 billion toward reliability measures would have made a huge difference in 2021 and put Texas in a much better position today.

The best way to correct this problem going forward is to ensure that variable generators pay for the extra reliability costs and backup power that the grid needs to support their existence. Unfortunately, the PUC’s preferred market reform idea, dubbed the Performance Credit Mechanism or PCM, places the entirety of the costs, estimated at over $5 billion annually, entirely on consumers. This approach may improve reliability, but only at a steep cost to consumers.

Taking Baby Steps

Fortunately, House Bill 1500, which renews the PUC for six years, takes some baby steps toward the goal of rebalancing the ERCOT market to the benefit of ratepayers. It requires the PUC and ERCOT to develop a requirement for all new generators, starting in 2027, to guarantee a certain amount of power during peak demand periods, although it leaves a lot of room to determine how the requirement can be met. The bill also requires the PUC to produce a study of different methods of allocating reliability costs to variable generators and to study whether requiring generators to get paid what they bid into the market, instead of a single market clearing price, can improve the balance of investment in the market.

The Texas Legislature also took some steps to eliminate the last vestiges of state subsidies for variable generators, including requiring new generators to pay for interconnection costs above a certain amount, eliminating the long-surpassed Renewable Portfolio Standard, and permanently eliminating property tax subsidies for wind and solar generation.

On top of all these changes to the ERCOT market, the Legislature allocated up to $5 billion to go toward loans and grants for new dispatchable power plants, with the potential for even more of these state subsidies in the future. At first blush, this influx of cash might seem to facilitate building more dispatchable power plants, and that is how the plan is being advertised. However, in the absence of significant new revenue and a more competitive market environment for dispatchable power plants, it is more likely that the new power plants will only serve to replace retiring plants and not appreciably increase the total amount of dispatchable power in the market.

Furthermore, once power plants enter the market backed by state dollars, it is unlikely that future dispatchable power plants can be built without state dollars and still compete. These subsidies for dispatchable power are chasing subsidies for intermittent power, and it is hard to see where the cycle ends—and Texas returns to having a truly functional electricity market.

Into this morass steps the PUC, which is again searching for new leadership and is uncertain how the PCM will fare amid the new requirements from the Legislature. While the consumer protection measures in HB 1500, which include a cost cap on any new reliability program, are important to make sure the PUC does not get out over its skis and raise costs too quickly, time is of the essence for market reform to start being implemented.

The last two years have seen the PUC and ERCOT work to address the immediate operational issues that resulted from Winter Storm Uri. The next two years will determine whether they can make the market reforms that are needed to ensure the reliability of the grid for many years to come, in the face of a relentless onslaught of federal subsidies and regulations. Ensuring variable generators pay for their share of the costs to shore up the reliability of the system is an essential step in that process.