The Texas Model that includes a relatively modest level of taxation has allowed the state to remain a leader nationwide in economic prosperity. This reputation, however, is not guaranteed; each session demands fiscally sound decisions in Austin.

If legislators wish to continue this success, they should take steps in the 2019 session to pass a historic third straight Conservative Texas Budget. To avoid the consequences of more spending and resulting higher taxes, 18 groups of the Conservative Texas Budget Coalition urge lawmakers to pass this budget that would increase by less than population growth plus inflation.

Such fiscally responsible decision-making would allow the government to continue providing essential services while keeping potentially higher tax burdens to Texans at the forefront.

Fortunately, the Texas Constitution’s balanced budget amendment confines spending to no more than expected tax collections, but it’s not a sufficient condition to ensure fiscal responsibility. Given taxation is ultimately determined by spending, the level of taxes could rapidly rise if it equals expected revenue.

In other words, if we want low taxes, we must first rein in spending. And fiscal conservatism hasn’t always been the norm in Texas.

According to a recent report by Texas Public Policy Foundation, spending in the current 2018-19 budget is up 7.3 percent more than the compounded growth of population plus inflation since the 2004-05 budget.

While at first glance this may not appear significant, the difference amounts to overspending of about $15 billion in the current budget. Without these past excesses, every family of four could have had an additional $1,000, on average, in their pockets each year.

Two sessions ago, legislators steered spending back in the right direction with the passage of a Conservative Texas Budget. Last session, they passed what could be the second straight Conservative Texas Budget.

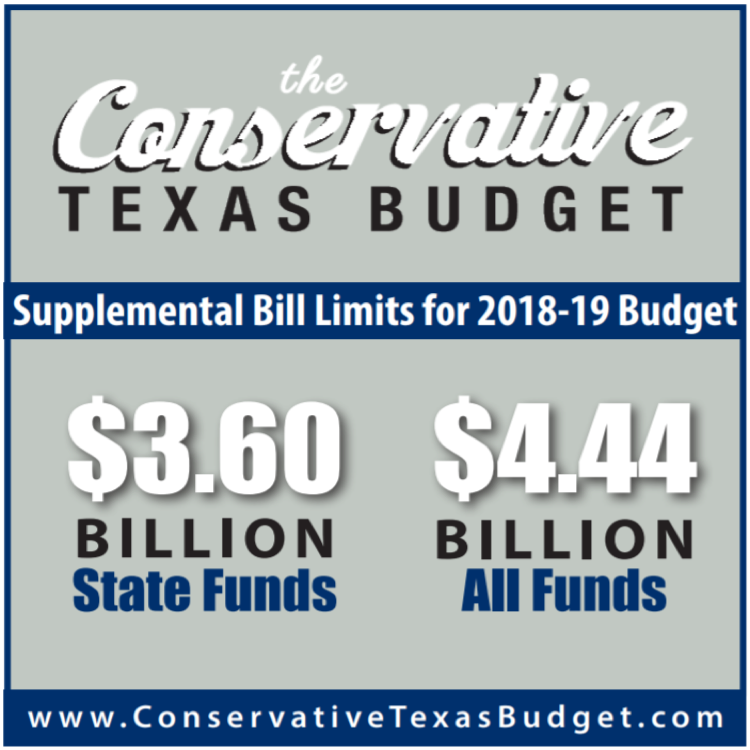

Figure 1 shows that there are funds available for a supplemental bill to finish the 2018-19 period, which should include the delayed $1.8 billion in transportation money along with a potential shortfall in Medicaid spending.

Figure 1. Conservative Texas Budget Limits for 2018-19 Supplemental Bill

Given the likely large supplemental for Hurricane Harvey recovery efforts, we intend to not include that spending in our budget metrics if they’re clearly identified and one-time expenditures. Therefore, there’s a clear opportunity to pass the third consecutive Conservative Texas Budget if legislators simply practice fiscal restraint.

While legislators have done just that the past two sessions, history has proven that each session presents challenges that could massively hike spending. Such a result shouldn’t be the course taken.

If the Texas Legislature hopes to ensure the prosperity supported by the Texas Model of limited government, Figure 2 notes the maximum amount of appropriations that qualify for a 2020-21 Conservative Texas Budget.

Figure 2. Conservative Texas Budget Limits for 2020-21 Appropriations

While these criteria set maximum increases in the state’s budget, they are by no means a threshold for necessary spending. Instead, legislators should spend even less to provide substantial tax relief to enhance Texas’ economic competitiveness and improve Texans’ opportunities to flourish.