The city of Whitesboro ignited a firestorm recently when officials suggested adopting a tax rate that would have skyrocketed the average homeowner’s property tax bill by 61 percent. The initial public hearing to discuss the matter drew hordes of angry Whitesboro residents who voiced their discontent. So much so, in fact, that city councilmembers tabled the radical increase for now. The next public hearing is set for Sept. 29.

The nature of Whitesboro’s indecent proposal is unique in some regard. After all, the threatened tax increase is mammoth, both in terms of actual dollar cost (+$498.73) and percentage growth (+61%). But it’s not entirely exceptional to see a small town pitch a huge tax hike today.

After surveying numerous Notices of Public Hearing on Tax Increase over the last few weeks—the fruit of which is showcased in the Foundation’s The Taxman Cometh series—it is obvious that many local governments are entertaining large tax increases. And some of most costly proposals are found in small cities with less than 5,000 population.

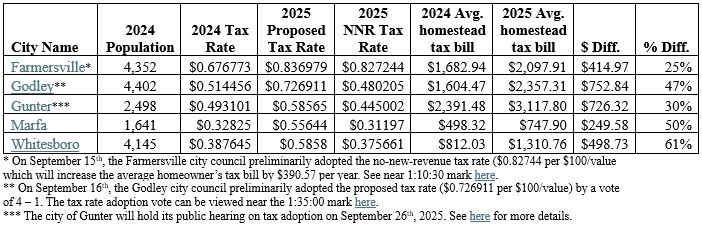

Below are 5 small cities that are either considering or have adopted a major tax increase. In some cases, these decisions will cost the average homeowner between $249 and $726 per year, which in percentage may mean affected homeowners experience between a ~25% to 61% jump in the city portion of their tax bill.

What these data suggest are three things in particular.

First, the fact that anyone’s tax bill might increase by 61% in a single year means that Texas’ property tax revenue limitation needs immediate improvement. Such an unthinkable increase allowed without voter approval signals major weakness and demands a legislative response (a few ideas here, here, here, and here).

Second, this data reveals that small towns aren’t immune to the tax-and-spend mindset. Indeed, while large, urban governments are often (deservedly) in the spotlight for their anti-taxpayer activities, local governments of every size and type seem to be intoxicated today by Other People’s Money, perhaps spurred on by the state-directed tax relief and the lack of strict fiscal rules.

As I’ve noted in the past, “Since 2019, the Texas Legislature has committed substantial resources toward reducing property tax bills, but lawmakers’ efforts have largely been frustrated by local decisions to raise rates, hold tax rate elections, propose large bond issuances, and overuse certificates of obligation.” The enabling factor in many cases has been the absence of a local spending limit, a balanced requirement, a debt limit, and/or other fiscal requirements to control the appetite of cities, counties, and school districts.

Third and relatedly, homeowners in these small towns will not see the full value of promised tax relief, which has been estimated at $484 for the average household. Worse, some residents may not see any tax relief at all because of local decision-making.

This is a difficult moment for small town Texas taxpayers and it begs the question: What is the next Texas Legislature prepared to do about it?