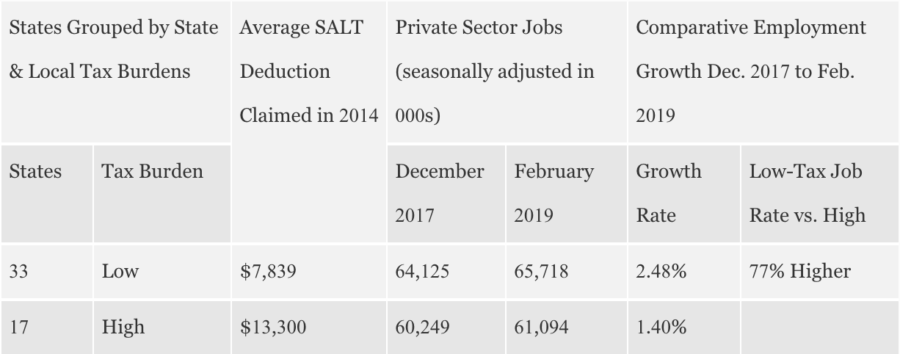

Since President Trump signed the Tax Cuts and Jobs Act of 2017 into law in December 2017, private sector job growth in states with smaller state and local tax burdens has run 77% ahead of states with heavier tax loads from December 2017 to February 2019. Among its provisions, the new law limited state and local tax (SALT) deductions to $10,000 per household, significantly curtailing the federal tax code’s subsidy of high-tax states.

There are 33 states where the average SALT deduction was under $10,000 in 2014. On average, the SALT deduction in these states was $7,839 per household, compared to $13,300 in the 17 high-tax states, which is 70% higher. For a small business owner filing individual federal taxes who pays at the 35% marginal income tax rate, the $10,000 SALT cap could mean paying an average of $1,155 more in federal taxes that a counterpart in the average low-cost tax state would pay. For the average tax return from New York, the difference would be about $3,850, since the average pre-tax reform SALT deduction was $21,000 in the 2014 tax year.

Many factors go into where and how many jobs are created or lost. Government tax and regulatory policy, the lawsuit environment, the availability of suitable labor and land, and access to capital all play a role.

While greater relative tax liabilities of from $1,000 to $4,000 per household among the 30% of households who itemize their taxes may seem like a modest change, spread out over 54 million tax returns in 50 states, it does add up, affecting decisions on where, when and how much to invest in job-creating businesses. And more so, when considering that 57% of American workers labor at businesses which employ fewer than 100 people. Most of these businesses are sole proprietorships, where the owner doesn’t pay federal corporate income taxes, but rather pays individual income taxes.

Because of the federal tax code’s new limitation on SALT deductions has had the same effect as changing the tax code at the state level in all 50 states—all at once. This makes state level economic performance—since the passage of the Tax Cuts and Jobs Act of 2017—particularly interesting.

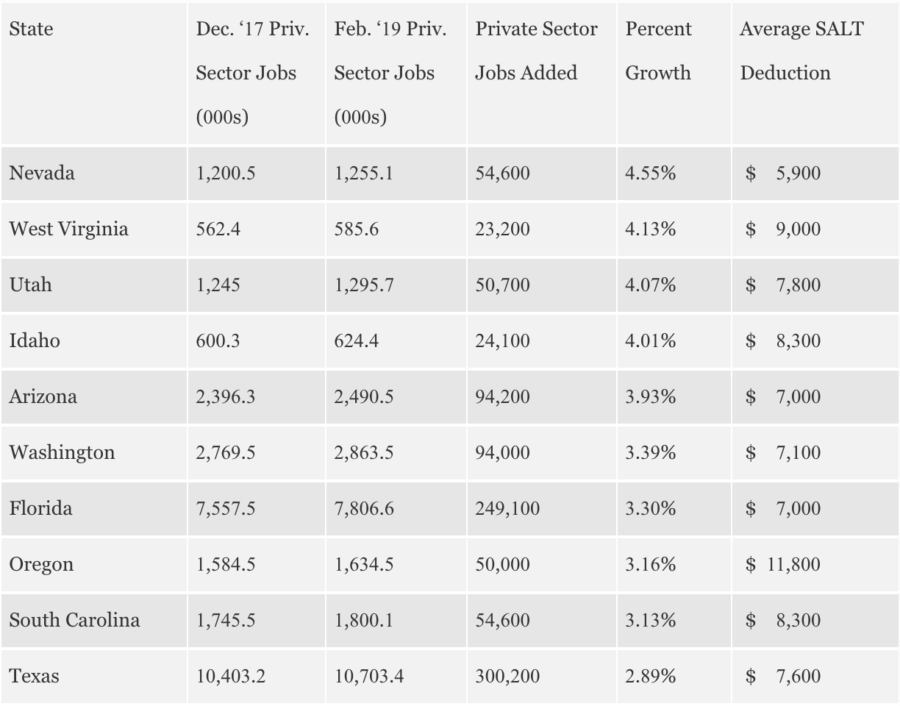

Looking at the 10 highest-performing individual states by private sector job growth (seasonally adjusted), showing total numbers and percent as well as their average SALT deduction, an interesting pattern emerges—all but one, Oregon, are in the low-tax state category. Oregon has an income tax, but no sales tax. There are seven states with no individual income taxes, with four of them, Florida, Nevada, Texas, and Washington, making the top 10 list for the states with the fastest-growing job market. South Dakota and Wyoming, two other states without an individual income tax, came in 12th and 15th, respectively, for their high rate of adding private sector jobs.

Among all the states, Texas added the most private sector jobs over the period: 300,200.

A portion of Oregon’s success in job growth may be due to the fact that its tax burden is at the low-end of the high-tax states grouping, while it benefits from being adjacent to California, a state with the 4th-highest claimed SALT deductions in 2014: $17,100.

However, even low-tax states aren’t guaranteed to stay that way. In Texas, for instance, voters carefully monitor their state-elected representatives—members of the House and Senate in the legislature—for their stance on taxes and spending. But at the non-partisan local level—school boards, counties and cities—a lack of safeguards against rapidly increasing property taxes threatens Texas’ status as a low-tax haven.

In fact, the U.S. Census Bureau’s Annual Survey of State and Local Government Finances, shows that in the latest 10 years for which data is available, Texas property taxes increased above the measure of population and inflation by about 1% per year while revenue controlled by the state legislature was closely in line with the population and inflation yardstick.

The data is clear: restraining state spending while cutting taxes encourages job creation.