Texans are struggling with high property taxes, soaring prices, and stagnant income. As a result, most big-budget players favor some property tax relief. For instance, Gov. Greg Abbot declared his intention to use half of the actual surplus fund ($16.3 billion) for this initiative. Likewise, Lt. Gov. Dan Patrick revealed that property tax relief is his first legislative priority.

However, the economic outlook for 2023 is not encouraging. The IMF has announced a slowdown in the global economy, and a third of the world’s economy is expected to be in a recession in 2023. Moreover, the consensus among large financial institutions is that the U.S. will have a recession this year.

Consequently, in such a bloomy scenario, caution is warranted on how to use Texas surplus funds prudently. Based on previous data, the Foundation finds that Texas has enough funds to use toward property tax relief, even in the worst-case scenario. Our three key findings are:

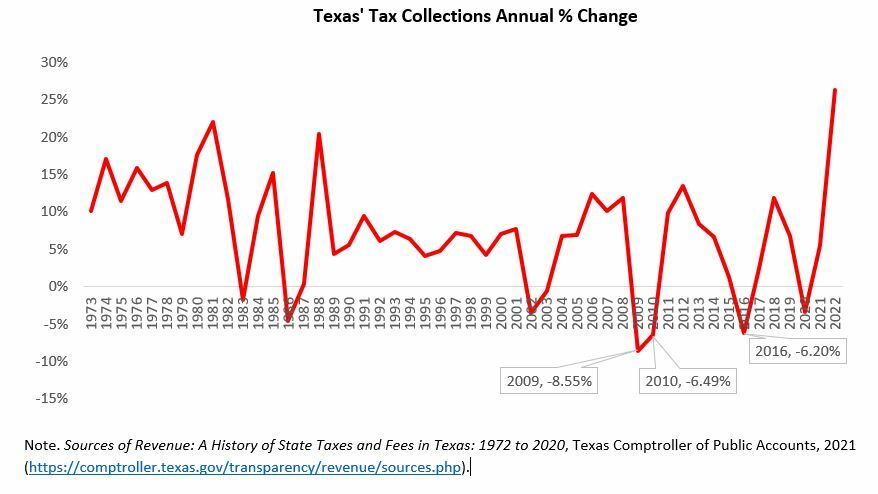

- The Great Recession caused the largest fall in tax collections: The 2009-2010 biennium represented a fall in tax revenue of 8.5% in the first year and 6.5% in the next period. Sudden drops in oil prices also caused a decline in tax revenue in 1986 (4.6%) and 2016 (6.2%). Other negative shocks in the State’s finances were the early 2000s recession (4.1% total) and the COVID-19 pandemic in 2020 (3.4%). The Great Recession and the early 2000s recession were the only events of negative growth in revenue in two consecutive years since at least 1973.

- The worst-case scenario is a drop in tax revenue of $11 billion: By considering the most significant decrease in tax revenue from the Great Recession, we can compute how much the state of Texas might lose in tax revenue in the event of a recession. According to the comptroller, tax collections for 2022 are $76 billion. If we input the falls of revenue of 8.5% and 6.5% from the Great Recession for the 2024-2025 biennium, the Lone Star State would lose $11 billion in tax collections in the worst-case scenario. Another useful indicator is the expected loss, the average of all the negative shocks Texas has experienced since 1973. The expected loss is 3.9%, representing a loss of $3 billion in a moderate adverse scenario.

- Texas would have enough funds to cover property tax relief: Even considering the worst-case scenario of the revenue shortfall, the state finances have enough cushion to assume the $11 billion loss from the rainy fund of $13.7 billion. That leaves the surplus funds of $32.7 billion untouched for substantial property tax relief. Additionally, a property tax cut would also serve as a countercyclical policy by keeping more money in the hands of those in the productive private sector. It would generate growth, create more jobs and help with the affordability crisis in the housing market. As a result, property tax relief can mitigate some of the harmful effects of a recession.

Considering that the State’s finances are robust enough to face a recession, the Foundation has proposed a path toward completely eliminating school districts’ maintenance and operations property taxes by using state surplus general revenue-related (GRR) funds to buy them down over time to zero.

By following the spending limit of population plus inflation, assigning at least half of the current surplus and 90% of the future surplus thereafter, we should expect the elimination of school district M&O property taxes over the next decade. In case of any revenue shortfall, school districts could cover it with their reserve funds.

By gradually replacing property taxes with more efficient sales taxes, more Texans would be able to boost their savings, afford a new home, and preserve their property while improving their ability to afford housing and other necessities.