Local government officials are leaning more heavily on nonvoter-approved debt instruments, like certificates of obligation (COs), than in years past. As a result, voters are increasingly denied the opportunity to voice their support or opposition to various capital projects and taxpayers are bearing a heavier burden without consent.

For anyone unfamiliar with the CO concept, the Texas Comptroller of Public Accounts describes it as a means by which: “to fund the construction, demolition or restoration of structures; purchase materials, supplies, equipment, machinery, buildings, land and rights of way; and pay for related professional services. COs are issued for terms of up to 40 years and usually are supported by property taxes or other local revenues.” While there is an argument to be made for the flexibility it provides in certain emergency situations—i.e. the need to repair roads after a natural disaster without having to hold an election—it is quite clear that officials are using these instruments far more than they should and for things that are not crisis-related.

For instance, in August 2024, the Denton city council was reportedly considering using CO debt to construct a new “$120 million city hall” that a citizen bond committee had left out of a 2023 bond package that totaled nearly $300 million. Citizens removed the item over concerns about the already-ballooning cost of the bond; but apparently city hall wasn’t impressed with that suggestion and is moving ahead with it in a different way.

In another instance, Bryan city officials approved a $43.3 million CO issuance in July 2024 which, among other things, included: “$1,100,000 in city-wide fiber, including fiber optic infrastructure and extension for signals. $12,500,000 is for existing facility upgrades and new facility projects including the design of the Public Works Operations Center, implementation of a facilities master plan approved in the FY23 Budget, and facilities maintenance (e.g. HVAC replacements, fire station doors.) $5,500,000 is allocated for streets, sidewalks and paths including streets and sidewalks near schools, A&M, and Wellborn. $7,700,000 is for parks and recreational facilities, including ballfield development and equipment replacement at Bee Creek, Brothers, Central, Southern Oaks, Merry Oaks, University Park and others.” While it’s not clear why the city didn’t ask voters to approve these items at a public election, one might surmise that officials were concerned that voters would say ‘No’ given their discretionary nature.

Elsewhere, other local governmental entities have proposed using CO debt for a host of other questionable purposes, including: building a water park, renovating a library, and even economic development.

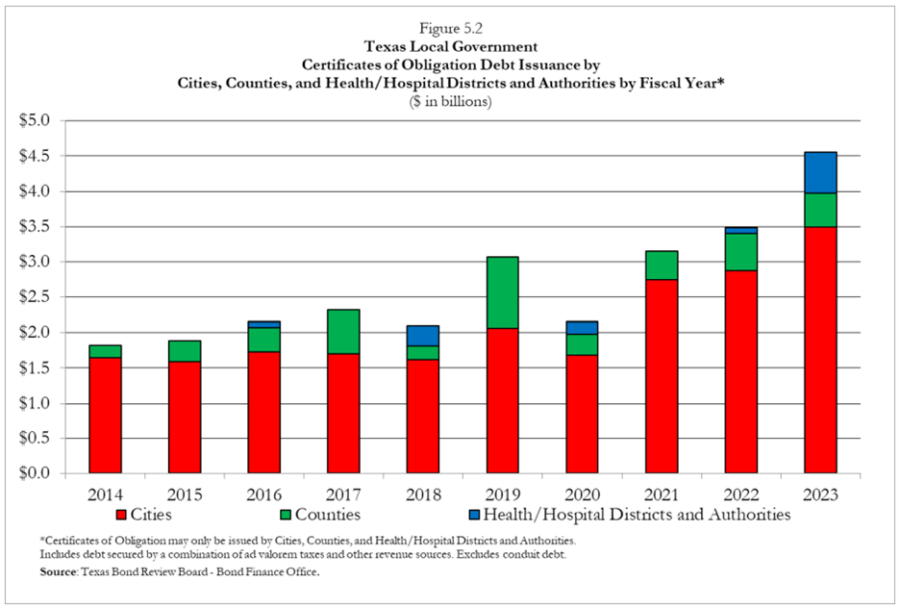

As a result of this spend-it-if-you-got-it mentality, CO debt has spiked considerably in recent years. Per the Bond Review Board (BRB): “Since fiscal year 2014, CO debt outstanding has increased by 65.8 percent ($9.00 billion) from $13.67 billion outstanding in fiscal year 2014 to $22.67 billion outstanding in fiscal year 2023. Cities accounted for 79.3 percent of the total CO debt outstanding at fiscal year-end 2023.” Curiously, this increased reliance on nonvoter-approved debt occurred at a time when local governmental entities were flush with cash, thanks to federal pandemic aid and soaring tax revenues.

Source: Bond Review Board’s 2023 Local Government Annual Report

The data makes clear that CO debt is rising steadily and its use isn’t always for mission critical purposes. In light of these two considerations, it may be time for policymakers to institute good government reforms and rein in the abuse.