The Certificates of Obligation Act of 1971 allows some governmental entities—like cities, counties, and certain special districts—to issue debt without voter approval to fund any public project.

More specifically, certificates of obligation (COs) can be used “to fund the construction, demolition, or restoration of structures; purchase materials, supplies, equipment, machinery, buildings, land and rights of way; and pay for related professional services.” As provided for in Local Government Code 271, Subchapter C, COs are usually payable from property tax revenues or other taxable sources.

While COs provide local governments with a flexible financing option to handle unforeseen circumstances or emergency situations, they are not restricted to only that use—which has been the source of recent controversy.

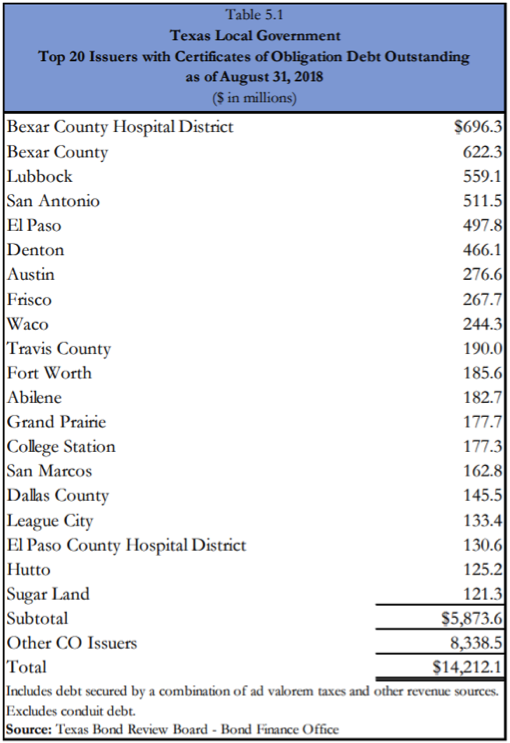

Over the recent past, COs have seen a modest uptick in use. According to the Bond Review Board: “Since fiscal 2009, CO debt outstanding has increased by 25.4 percent ($2.88 billion) from $11.33 billion outstanding in fiscal 2009 to $14.21 billion outstanding at August 31, 2018. At August 31, 2018, cities accounted for 78.8 percent of the total CO debt outstanding.”

Which local governments are the top issuers? The graphic below shows the top 20 issuers with certificates of obligation debt outstanding whose combined debt accounts for more than 40 percent of the total.

Source: Texas Bond Review Board, Local Government Annual Report 2018

Given Texas’ ongoing challenges with high property taxes and wasteful CO spending, it’s not unreasonable to think that legislation will be filed soon to rein in their use. Perhaps something along the lines of Senate Bill 310 from the 84th Session?