Where have we heard this before? A city adopts a new tax rate that is technically a decrease, but due to rising appraisals, taxpayers will actually end up paying more.

This sort of stealth tax increase has become ubiquitous, and now the city of Houston, Texas largest city, becomes the latest jurisdiction hike taxes in this way, joining the likes of Dallas, Beaumont, and others.

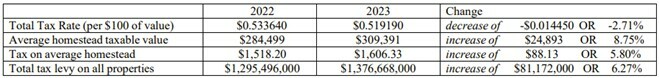

Last week, a majority on the Houston city council adopted a new tax rate of $0.519190 per $100 of value, which is 1.4 cents, or about 2.71%, lower than the previous rate of $0.533640 per $100 of value. Such a small rate decrease was not enough to offset the rise in property value growth, which means that the average taxpayer will pay higher taxes to the city.

Womp. Womp.

So what can the average homeowner expect? About a 6% increase in their city property tax bill.

According to the city of Houston’s Notice of Public Hearing on Tax Increase, the tax bill on an average homesteaded property will rise from $15,18.20 imposed this year to $1,606.33 due next year, which is an annual increase of about $88.13. Overall, the city’s tax levy will grow from $1.295 billion to $1,377 billion, which is the equivalent of a 6.3% increase.

With the economy uncertain and inflation continuing to eat away at the family budget, many are wondering why the city of Houston is hitting homeowners with higher taxes right now and making to the cost-of-living crisis worse.

Instead of raising taxes, Houston and others should get serious about fiscal responsibility and use tools like zero-based budgeting and efficiency audits to lower the cost of city government—and pass along those savings to struggling families in the form of a truly reduced tax rate.