On Thursday, the FOX television affiliate in El Paso, KFOX14, published an article related to local property taxes that is raising eyebrows for promoting 2 very misleading arguments. Let’s briefly review each one and see if we can spot the fallacy.

The first troubled argument can be found in the opening paragraph, which advances the following claim:

“Residents in El Paso are expressing frustration over rising property tax bills, despite the city maintaining the same tax rate for the upcoming year. The increase is attributed to a surge in property values.” [emphasis mine]

To spot this error requires some basic understanding of how the property tax system works. Crudely speaking, one’s property tax bill is the product of two variables: tax rates and property valuations (less exemptions). It can be expressed like this:

Tax Rates * Property Values (less exemptions) = Your Property Tax Bill

Ideally, an inverse relationship should exist between tax rates and property values. As one goes up, the other should come down so as to mitigate any harm to the taxpayer. However, when one variable is kept constant (i.e. tax rates) while the other variable rises (i.e. property values), then the taxpayer faces the prospect of abuse.

Returning to the El Paso example, in this case, the city is poised to maintain the same tax rate as the prior year (i.e. $0.761405 per $100 of value), despite the fact that property values are expected to increase by 10% in 2025. What this signals is a complete disregard for property taxpayers.

See, while the city cannot control property value fluctuations, it has almost total control over its tax rate-setting process. So if city hall sees that property values are going up, then it has the discretion and the authority to adjust its tax rate downward, instead of maintaining it at the same level. Its refusal to make any meaningful adjustment means that it is intentionally raising taxes on property owners while using property values as political cover.

Let’s move on to the second troubled argument. The article states:

“Art Fierro, a City Council member, acknowledged the challenge, saying, ‘Again, the unfortunate part is nobody wants to pay higher taxes. I mean, I don’t want to pay higher taxes. Having said that, I don’t want to cut the biggest part of our budget, which is law enforcement.’” [emphasis mine]

The issue here is actually so widespread that it’s been nicknamed the Washington Monument Syndrome (WMS). The phenomenon refers to the tendency of endangered politicians and bureaucrats to offer up “first cutting the government stuff that people like.” Like law enforcement. In so doing, these officials can deflect criticism of the policy choice under consideration and seek to win over a leery public because, after all, there is no other option.

In the El Paso instance, city officials seem to be using the WMS tactic to make the following claim—let us raise taxes (again) or we’ll be forced to slash public safety.

For the sake of this argument, let’s ignore that El Paso’s population has only grown by 1% over the last 10 years (674,061 in 2015 v. 681,273 in 2024) even while its police and fire budgets rose by 60% over a similar period ($213 million in 2015 v. $339.5 million in 2025). Rather than focus on this aspect, let’s briefly explore the city’s 2025 budget to see if there are any other areas that might serve as a suitable alternative to public safety cuts.

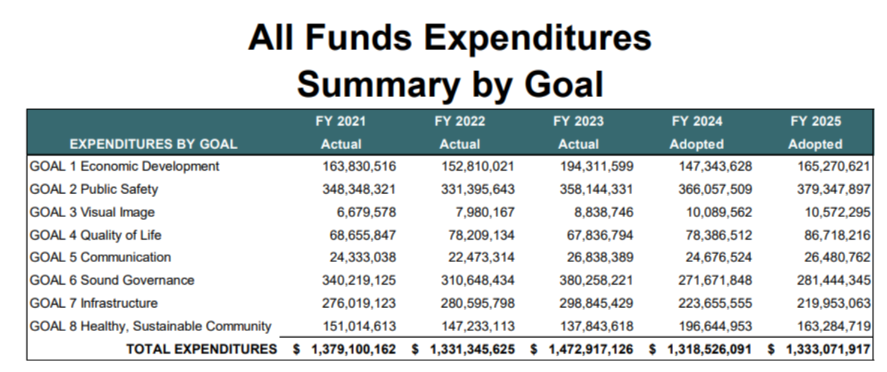

A quick review of the budget reveals several possibilities, like economic development ($165.3 million), visual image ($10.6 million), quality of life ($86.7 million), communication ($26.5 million), sound governance ($281.4 million), and/or healthy, sustainable community ($163.3 million). This is not to say that each category holds nothing meritorious, but rather that each of these functions should be carefully scrutinized for waste, fraud, and abuse before any talk of eliminating law enforcement can be taken seriously.

With that argument dispensed with, we can now see the 2 common fallacies in KFOX14’s otherwise informational article. While it likely wasn’t the outlet’s intent to push these misleading ideas, they did provide the public with an opportunity to learn and debunk frequent myths surrounding the property tax.

With that argument dispensed with, we can now see the 2 common fallacies in KFOX14’s otherwise informational article. While it likely wasn’t the outlet’s intent to push these misleading ideas, they did provide the public with an opportunity to learn and debunk frequent myths surrounding the property tax.

That’s something that Texans must get better at spotting and confronting if we’re ever to truly get control of our tax bills.