It’s that time again when city officials all across the Lone Star State begin to consider where to set next year’s tax rate (the fiscal year for most political subdivisions begins Oct. 1 of every calendar year). The tax rate adoption process is one area in which city officials have tremendous discretion—which means that if your tax bill goes up, then it’s because your local elected officials set the tax rate higher than they should have.

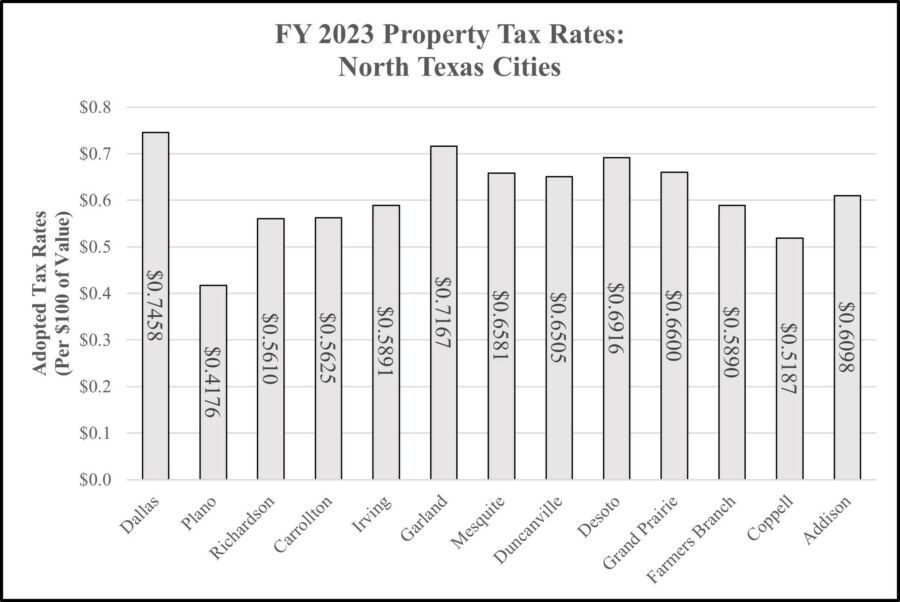

While this process is unfolding everywhere right now, let’s zoom in on North Texas cities specifically and get a handle on their starting point. That is, where are their tax rates now (for the current fiscal year—FY 2023) and how do they compare.

Here’s what that data looks like.

Source: Dallas Central Appraisal District

Hence, based on the data, it’s obvious that the city of Dallas currently levies the highest property tax rate ($0.7458 per $100 of value) of any of the municipalities shown, which should prompt officials to consider radically reducing rates. Dallas’ high ranking is followed by the cities of Garland ($0.7167), Desoto ($0.6916), and Grand Prairie ($0.66).

For a tax-weary public, this information might provide some helpful context on which cities are going overboard and which need to adopt the no-new-revenue tax rate in the coming fiscal year.