School districts across the state are anticipating the passage of the property tax relief proposition by voters this November and are already poised to slowly erode any relief that taxpayers may receive.

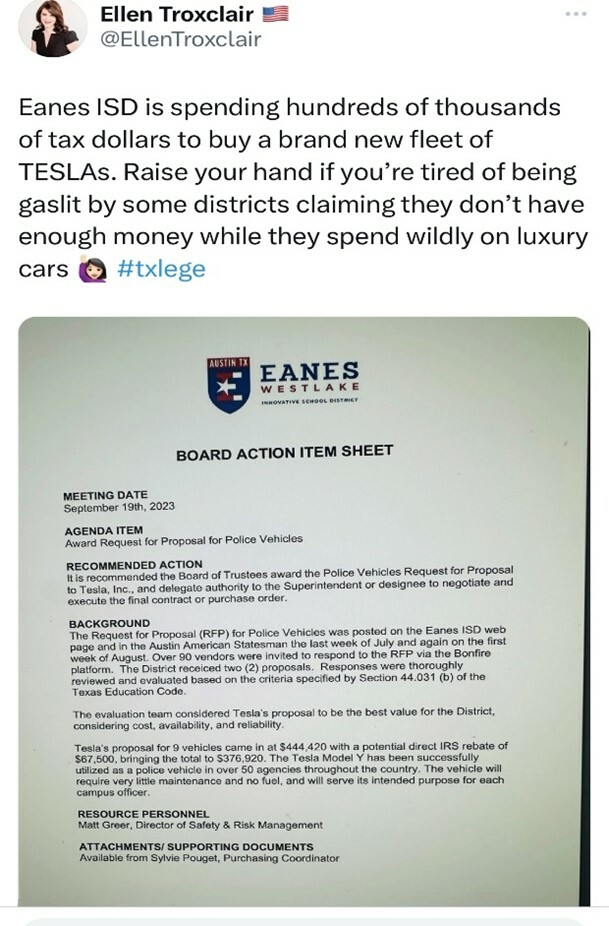

Outside of the monuments to future generations debt that are some high school district sports complexes, or the absurd salaries and benefits awarded to redundant higher-level administrators apparently now districts have made the foray into electric vehicles. Ellen Troxclair has called out Eanes ISD for approving a new Request for Proposal for police vehicles. That’s because instead of purchasing normal gas-powered vehicles, Eanes has opted for Tesla Model Ys for its police. The cost of providing nine of these vehicles came in at $444,420.

While Eanes ISD is wealthy enough to bear the initial brunt of this kind of purchase, this opens up questions. During a summer in which citizens were asked to be mindful of how much they draw from the grid, how can a school district justify adding more strain on that grid to accommodate the new vehicles? In a state where there is a teacher shortage, where educators and support staff beg for higher salaries, how can a district justify spending what could be nine full teacher’s salaries on what amounts to luxury cars for school police officers? In an economy that is suffering from inflation where it is becoming more difficult to purchase a home, how can a school district justify spending nearly half a million dollars on unnecessarily lavish squad cars?

Eanes has since tabled the proposal, for now, likely based on the attention brought to the possible transaction by Troxclair. But it is indictive of a larger problem throughout the state. Voters will go to the polls in November to approve the historic property tax relief bill that will save the average taxpayer around $2,600 for the biennium.

However, local governments including school districts are continuing to use debt instruments or calling for elections to increase tax rates, which may lead to families feeling less of the impact of property tax relief than they should. Typically, in times of plenty, it is important to save for the lean times. Watching districts, especially wealthy ones, spend money just because they have it on hand reminds me of the old adage “a fool and his money are soon parted.”