The city of Irving’s property tax is growing quickly, causing some observers to wonder why.

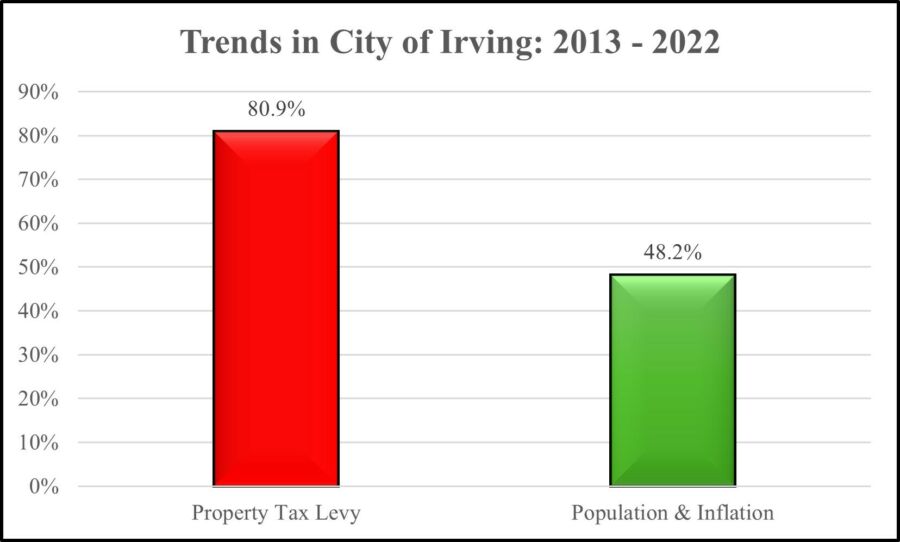

According to its latest available Annual Comprehensive Financial Report (ACFR), the city’s property tax levy rose from $103,633,782 in 2013 to $187,488,649 in 2022, representing an 80.9% spike over 10 years (see pg. 186 of the ACFR). That high rate of increase far outstripped the combined growth of population and inflation.

In 2013, the number of people residing in Irving totaled 220,750. By 2022, that figure had grown to 261,350, representing an 18.4% increase (see pg. 189 of the ACFR). Simultaneously, inflation rose by 25.6% (see CPI – U.S. city average, All items). Hence, population and inflation in Irving increased by a combined 48.2%.

The difference between these two measures—i.e. actual growth rate vs. ideal growth rate—suggests that the city is over-taxing property owners and should do more to limit its appetite, like voluntarily undergo a third-party efficiency audit, regularly employ zero-based budgeting, or utilize other strategies to bring down costs. By taking these steps, city officials can bring balance to its property tax system and better protect hard-working Texans.

What do you think—is the city of Irving taxing too much?