Part 3: Economic Problems With Student Loan Forgiveness

Student loan forgiveness also suffers from several economic problems.

Forgiveness Is Expensive and Has a High Opportunity Cost

The first economic problem with student loan forgiveness is that it is expensive, using vast sums of money that could be used for more pressing needs. Current and former students owe $1.6 trillion in federal student loans. Spending $1.6 trillion to forgive their loans will reduce the funding available for other uses.

The enormity of the sums involved has led some advocates to push for capping the amount forgiven at $50,000 or $10,000. But even then, in sheer magnitude, canceling $50,000 in student debt would rank among the largest transfer programs in U.S. history. At a cost slightly above $1 trillion, it would equal the total amount spent on cash welfare since 1980. And its largest effect would be to improve the finances of college-educated workers, who have already tended to be [economic] winners. (Looney, 2020, para. 10)

Others have advocated for forgiveness targeting certain subpopulations. Financial aid expert Mark Kantrowitz provides estimates (without necessarily endorsing the idea) that forgiving the federal student loans of borrowers age 65 and older would cost $59 billion, and affect more than 2 million borrowers. … Forgiving the federal student loan debt of social workers would cost about $18 billion. Forgiving the federal student loan debt of teachers would cost about $117 billion. Forgiving the federal student loan debt of all doctors and nurses would cost about $248 billion (Kantrowitz, 2021a, p. 3).

It would also be possible to avoid forgiving the loans of high earners by means-testing forgiveness, only forgiving the debt of former students below an income threshold. Matthew Chingos estimates that “income-based targeting reduces the total amount of loans forgiven by about one-third, significantly reduces the share of benefits going to the highest-income families, and modestly increases the share of benefits going to low-income groups” (Chingos, 2019, para. 9).

The amount of money required for even partial loan forgiveness is massive, and there are much better uses for that money. To illustrate the opportunity cost of student loan forgiveness, consider the student loan payment pause established by President Trump and continued by President Biden which temporarily paused all student loan payments during the COVID-19 epidemic. This payment pause costs taxpayers roughly $5 billion per month (The Great Student-Loan Income Transfer, 2021), and was recently extended by President Biden until September 1, 2022. This $60 billion per year is roughly twice as much as total spending on Pell Grants (funds that are provided to generally lower-income students to attend college and do not need to be repaid). In other words, for the same cost as extending the payment pause for a year, we could have tripled Pell Grants. Similarly, the Committee for a Responsible Federal Budget calculates that “the annual cost of extending the moratorium is about five times the total estimated cost of President Biden’s plan to provide free community college,” concluding that “while this expensive and regressive policy may have been justified in the depths of the pandemic, it no longer makes sense, particularly in comparison to other, better-targeted higher education reforms” (Committee for a Responsible Federal Budget, 2021b, para. 3).

Wasteful Rent-Seeking Such as Lobbying Would Increase

As noted earlier, forgiving loans will lead to future calls for more forgiveness, and those efforts will divert resources, time, and attention from productive activities and instead use them for wasteful lobbying that just seeks to redistribute wealth and income. As Justin Wolfers wrote, do this once, and what will happen in the next recession? More lobbying for free money, rather than doing something socially constructive. Moreover, if these guys succeed, others will try, too. And we’ll just get more spending in the least socially productive part of our economy—the lobbying industry. (Wolfers, 2011, para. 8)

Forgiveness Does Not Provide Much if Any Economic Stimulus and May Even Shrink the Economy

As noted earlier, student loan forgiveness advocates argue that forgiveness would provide economic stimulus by increasing the wealth and disposable income of debtors. They argue that the increased savings and consumption this would generate would increase the size of the economy by around $100 billion per year in the first five years after loans are forgiven (Fullwiler et al., 2018, p. 15).

However, most economists who have examined the issue disagree. The Committee for a Responsible Budget concludes that “student debt cancellation would be an ineffective form of stimulus, providing a small boost to the near-term economy relative to the cost. … Student debt cancellation will increase cash flow by only $90 billion per year, at a cost of $1.5 trillion” (Committee for a Responsible Federal Budget, 2020, para. 2-3).

Beth Akers agrees: many have argued that loan cancellation would provide a valuable stimulus to the economy… however, the magnitude would be small relative to the cost. This is because the benefits would be disproportionately delivered to higher-income borrowers and because the benefit would not be delivered immediately but rather through alleviating payments that were due monthly for decades into the future. There are far more effective forms of stimulus that could be immediately enacted if this were a priority. (Akers, 2021c, p. 3)

Some prominent economists even argue that forgiveness could reduce the size of the economy.

Why the vast disagreement, with some economists arguing that student loan forgiveness would provide substantial stimulus to the economy, most economists thinking it would provide minimal stimulus, and some even arguing it would shrink the economy?

The key question is whether the stimulative effect of student loan forgiveness in the form of an increase in net wealth and disposable income of former student loan debtors are offset by factors that shrink the economy and/or whether they have positive feedback loops. Tracking all the offsetting and positive feedback effects from a policy change is impossible, but if the biggest factors are accounted for, a reasonably accurate assessment can be provided. Economists often use the concept of a multiplier as shorthand for how stimulative (or not) a policy is after taking into account these offsets and positive feedback loops.

For student loan forgiveness, a simplified version of the multiplier with all else held constant would be the total increase in the size of the economy (GDP) divided by the total cost of loan forgiveness. In other words, if $1 spent on loan forgiveness generates $1 in additional economic activity, then the multiplier would be 1. Multipliers greater than 1 are considered to provide stimulus because each dollar spent generates more than a dollar of additional economic activity. A multiplier less than one indicates that each dollar spent generates less than a dollar of additional economic activity, and such a policy is not considered stimulative. For student loan forgiveness, if the macroeconomic offsets are numerous and large, the multiplier will be less than one or even negative. But if there are positive feedback loops, the multiplier could be greater than 1.

What is the multiplier for student loan forgiveness?

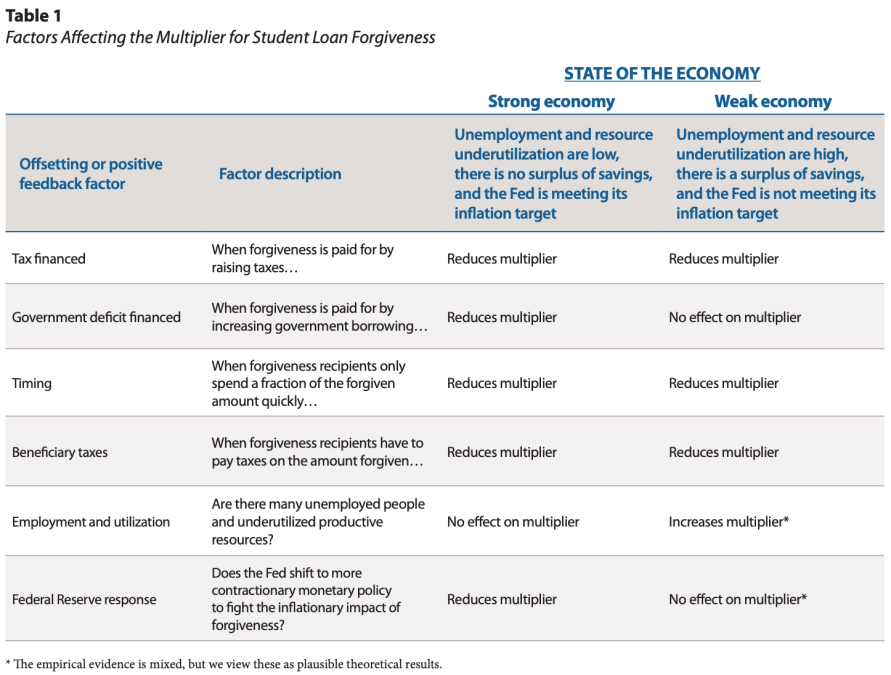

There is no single and stable answer to that question. Table 1 provides a summary of how various factors would affect the multiplier for student loan forgiveness.

Whether forgiveness is financed by higher taxes or increased government borrowing will impact the multiplier. Forgiveness implemented before 2025 will likely have a higher multiplier than forgiveness in 2026 or later due to President Biden’s temporary policy of exempting forgiveness from taxation. Similarly, much may depend on the overall state of the macroeconomy. Forgiveness when unemployment is high could have a higher multiplier than forgiveness in a typical year. Similarly, in a normal year, forgiveness could be offset by crowding out, whereas if the economy is very weak, crowding out may not be a concern. And much also depends on the Federal Reserve’s reaction, which will depend on forgiveness’ effects on inflation (itself likely driven by the amount of slack—unemployed people and resources—in the economy).

As of early 2022, the multiplier from student loan forgiveness is likely to be close to zero or even negative because no matter how forgiveness is paid for, it would likely have no or even a negative effect on the size of the overall economy. If it is paid for with higher taxes, money is simply shifted from one person to another, yet the deadweight losses from taxes shrink the economy. If it is paid for with more deficits, someone has to buy the bonds to pay for these deficits, reducing the investment or consumption spending that would have otherwise utilized those funds. If it is paid for with inflation, that is just taking purchasing power from everyone and giving it to a few. Even more important, the economy is currently suffering from the worst inflation in decades. This indicates that the Federal Reserve, seeking to bring inflation back down, would likely offset most of the potential stimulus provided by student loan forgiveness by shifting to a more contractionary monetary policy. Other analysts also predict a low multiplier, with the Committee for a Responsible Federal Budget estimating the multiplier is between 0.02 and 0.27 (Committee for a Responsible Federal Budget, 2021a).

In summary, the notion that student loan forgiveness would stimulate the economy is incorrect. While some forgiveness advocates argue the multiplier is 1.5, this result relies on questionable simulations and bizarre assumptions (such as ignoring the Fed’s response) that artificially inflate the multiplier. The actual multiplier is likely to be close to zero or even negative.