Is the city of Denton preparing to hit homeowners with a big-time tax increase? It certainly looks that way.

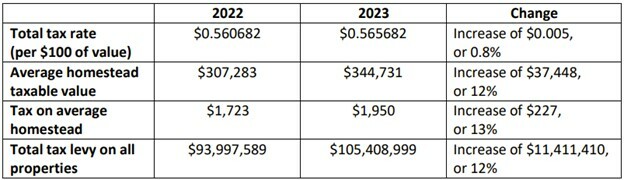

According to the city’s recently-published Notice of Public Hearing on Tax Increase, councilmembers will soon consider the adoption of a tax rate set at $0.565682 per $100 of value, which is a slight increase over last year’s tax rate ($0.560682 per $100 of value). This higher tax rate paired with the growth in property values means that the average property owner’s tax bill will go up this year.

So get ready, Denton taxpayers.

Now, the degree to which city taxes may rise is dependent on a few different variables, like what the actual adopted tax rate is, what a property’s value and type are, and kind of exemptions that have been granted. Even still, residents can get a sense of the likely tax hike by examining a few details provided in the aforementioned notice.

For example, the city’s notice provides the following—if Denton officials were to adopt the proposed tax rate of $0.565682 per $100 of value, then the owner of a home valued at $344,731 could expect their city taxes to jump by $227 per year. That is an estimated 13% increase in the average homesteader’s tax burden. Of course, it’s not just homeowners that will pay more for the cost of city government; renters and businesses can also expect to shoulder higher taxes under the proposed rate. This could well translate into higher prices, slower wage growth, and marginally less economic activity for everyone involved.

Source: Notice of Public Hearing on Tax Increase

What do you think—is such a large tax increase justified, or should the city of Denton be doing more to lower taxes and help people cope with today’s cost-of-living crisis? A public hearing on the proposed tax rate is set for September 19, 2023 at 6:30 p.m.