Earlier this month, the Texas Public Policy Foundation published a new report looking at the heavy burden of property taxes in Texas’ major urban areas.

In the report, the authors compare the growth of property tax levies with population and inflation increases in the top 10 most populous cities, counties, and school districts. The facts and figures are aimed at helping taxpayers better understand how fast taxes are growing and how fast taxes should be growing.

In El Paso, taxpayers are getting walloped as evidenced by one local media outlet’s reporting late last year. In September 2021, KVIA interviewed resident Perla Aguilera who is facing skyrocketing tax bills to the extent that she’s considering moving to New Mexico for tax relief.

More:

“Perla Aguilera has owned her home in the Canutillo area since 2008 and is facing a property tax bill approaching $6,000 this year. She and her husband have considered moving across the state line to find relief from higher property taxes.”

…

“The property tax bill on [Aguilera’s] Upper Valley home has increased 43% — more than $1,700 — since 2012. That includes $700 more they’ll have to pay this year compared to 2020, a 14% increase.”

Aguilera’s experience is not an isolated one. Virtually every El Paso-area resident is feeling the weight of local government.

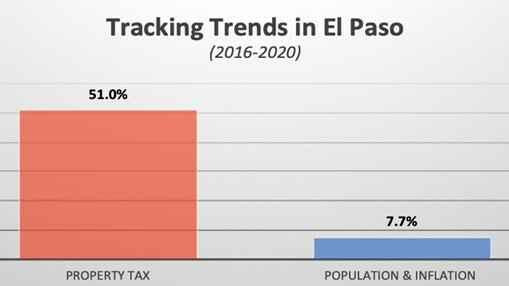

From 2016 to 2020, the city of El Paso’s property tax burden increases by 51% whereas its population and inflation grew just 7.7%. That means the city’s property tax outgrew its ideal growth rate by more than 6-to-1.

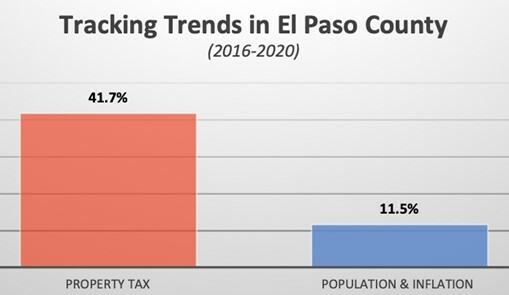

Similarly, El Paso County’s tax burden is also cause for concern.

From 2016-2020, El Paso County’s tax levy increased from $178.2 to $252.5 million, representing a growth of 41.7%. At the same time, the county’s population and inflation measures rose just 11.5%. The discrepancy strongly suggests that local officials need to exercise much greater restraint and responsibility.