Midway through, there’s little sign of assured tax reform, and none at all of permanent tax relief.

The Legislature still has time to achieve both of these goals—if it will stand up to the lobbyists of the local governments (paid for with taxpayer funds) who want to preserve their ability to raise their revenues with little accountability.

The Texas Legislature must act this session. They need to hear from you — their constituents.

Find your State Legislators

Talking Points to Share:

- Studies suggest that oppressive taxes can discourage economic growth and activity, distort investment decisions (especially among capital intensive industries), and depress job creation.

- In fiscal 2017, more than 4,000 local taxing jurisdictions hit homeowners and businesses with tax bills totaling almost $60 billion.

From 1998 to 2017, Texas’ local property taxes grew by 212%. In comparison, population growth and inflation increased by only 114%.

From 1998 to 2017, Texas’ local property taxes grew by 212%. In comparison, population growth and inflation increased by only 114%.- On a per capita basis, Texas’ property tax is large enough to collect more than $2,000 from every man, woman, and child in the state or more than $8,000 from a family of four.

- Texans shouldn’t feel like tenants in their own homes while local governments play the role of landlord.

Recommendations:

- Limit spending

- Impose revenue triggers

- Work toward eliminating the maintenance and operations portion of Texas public school property taxes—the biggest portion of your tax bill.

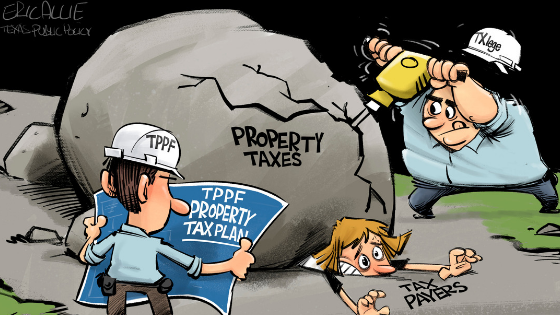

TPPF has a plan to truly cut property taxes and lessen the burden. Our plan achieves these goals without making cuts to critical priorities like public education and safety. Further, the TPPF plan achieves these goals without making cuts to critical priorities like public education and safety.