The Challenge

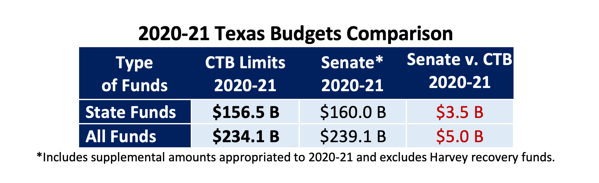

CSHB 1 exceeds the Conservative Texas Budget (CTB) limits on state funds and all funds spending by $3.5 billion and $5 billion, respectively.

The Opportunity

The Foundation has consistently made it clear that state money used to provide lasting property tax reductions would not be counted as spending under the CTB. The Senate could, then, get below the CTB limits by repurposing the $2.3 billion tentatively allocated to public education (TEA Rider 80) and the $2.7 billion currently dedicated to generic property tax relief (TEA Rider 81) to lasting property tax reductions beginning in the 2020-21 biennium. In order to be exempted from the CTB spending calculations, the $5 billion would have to be used to buy down school property taxes using a mechanism similar to the one outlined in the Foundation’s plan to Abolish the “Robin Hood” School Property Tax.

Budget Comparison

The table below shows that the Senate’s 2020-21 budget, which includes CSHB 1and amounts allocated in the supplemental bill and excludes Harvey recovery funds, would—if it became law—end the possibility of a third consecutive CTB. The amounts of state funds and all funds (includes federal funds) exceed the CTB limits based on an 8 percent increase in population growth plus inflation over the last two fiscal years.

CSHB 1 should be amended by the Senate to reduce all funds spending by $5 billion. This reduction could include shifting funds to property tax relief as outlined above.