School district property taxes are massive.

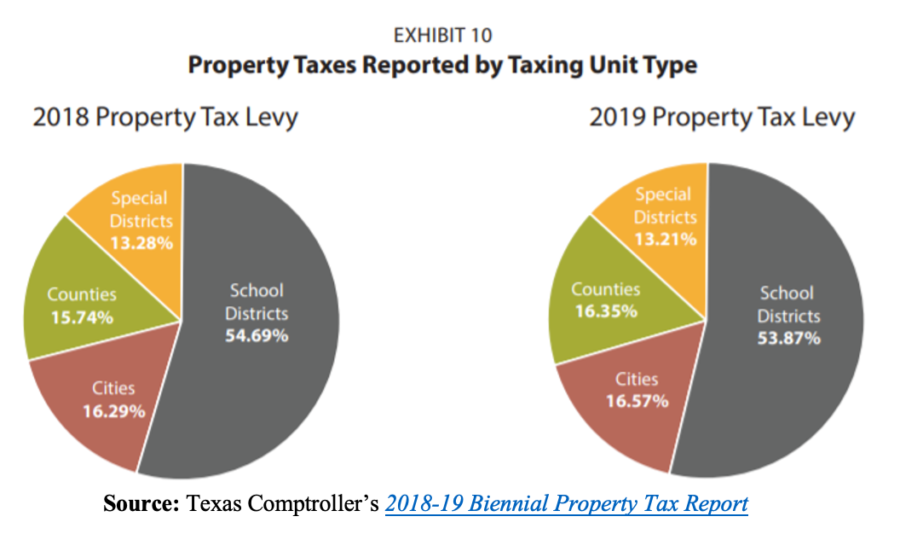

In 2019, Texas’ local governments walloped homeowners and businesses with property taxes totaling $67.3 billion, according to a new Texas Comptroller report. Of the total tax levy, school districts, by far, imposed the greatest burden at $36.2 billion or 54% of the whole.

By comparison, property taxes levied by cities totaled $11.2 billion (16.6%); by counties $11 billion (16.4%); and by special districts $8.9 billion (13.2%). Figures may not add due to rounding.

Source: Texas Comptroller’s 2018-19 Biennial Property Tax Report

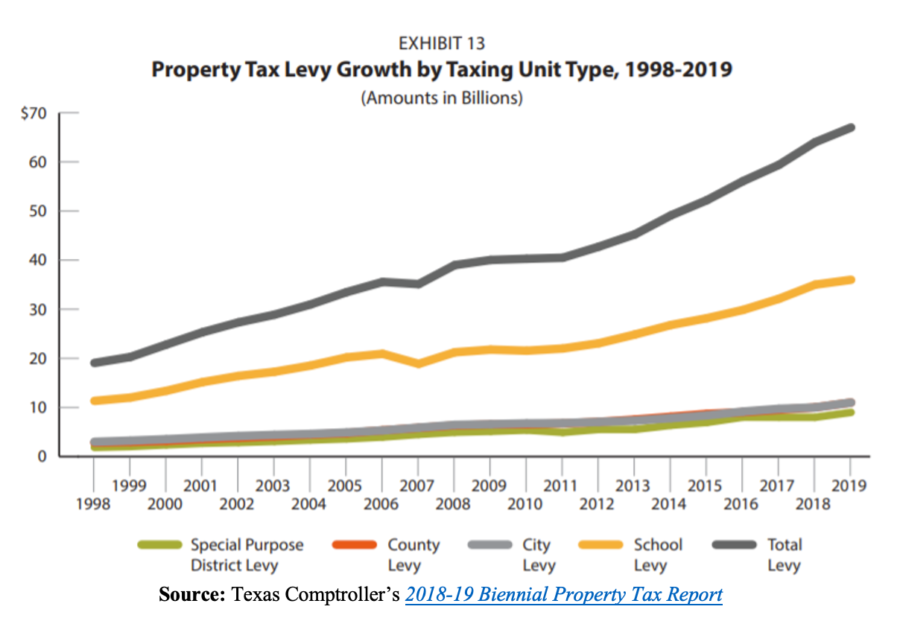

Looked at another way and over a longer period (1998 – 2019), it is quite clear which local governmental entity is responsible for the bulk of Texas’ property tax problem.

Source: Texas Comptroller’s 2018-19 Biennial Property Tax Report

The Texas Comptroller’s latest report confirms the findings of a Texas Public Policy Foundation report published in October 2020 that examined property tax trends in populous areas (see: Just the Facts: Property Taxes in Texas’s Most Populous Cities, Counties, and School Districts). In the report, the authors write:

School district property taxes rose sharply from 2014 to 2018. In almost every instance, school district property tax levies [for the ten most populous ISDs] soared past enrollment growth and inflation increases. In certain cases, the rate of levy growth was practically unexplainable given the decline in student enrollment.

And so the evidence continues to mount that school district property taxes are big and growing fast, pushing some Texans to brink. State lawmakers must do more to tackle this issue in earnest and come prepared with fresh, bold ideas to move us in a radically better direction.