Today, the Texas Public Policy Foundation published Just the Facts: Property Taxes in Texas’s Most Populous Cities, Counties, and School Districts.

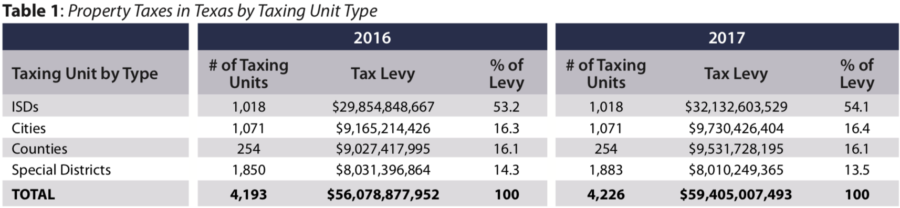

“The local property tax is the biggest tax in Texas,” said James Quintero, policy director of the Government for the People campaign at the Texas Public Policy Foundation. “In 2017, more than 4,000 local governments hit homeowners and businesses with property tax bills totaling almost $60 billion. That’s a large enough tax levy to take $2,000 from every man, woman, and child in Texas or $8,000 from a family of four.

“The property tax is not only large, but it has grown quickly for a long time. From 1998 to 2017, the average annual increase in the property tax levy jumped was almost 6%. That is a relentless sort of growth that is driving affordability crises in many areas around the state, especially in the most populous parts.

“In each of Texas’ ten largest cities, counties, and school districts, property taxes have grown much more quickly than traditional economic measures, like population and inflation. The next Texas Legislature must do more to slow the growth of property taxes and stop local governments from taxing people out of their homes. Big, bold changes are needed now.”