I have asthma. Once a month, I’d trudge to the pharmacy and plunk down a $20 copay for my Advair maintenance inhaler. I had a Preferred Provider Option (PPO) insurance plan—a beautiful 80/20 plan with unbelievably low premiums, deductibles, and copays thanks to a generous benefits package from my former employer.

Now I find myself on a High Deductible Health Plan (HDHP) paired with a Health Savings Account (HSA) —designed to make me a better consumer of health care. Intuitively, I like the concept of a HDHP. My auto insurance policy doesn’t cover basic maintenance like oil changes or wiper blades, and neither should my health insurance. It’s there to cover expenses I can’t handle, whether it’s repairing collision damage or replacing a knee.

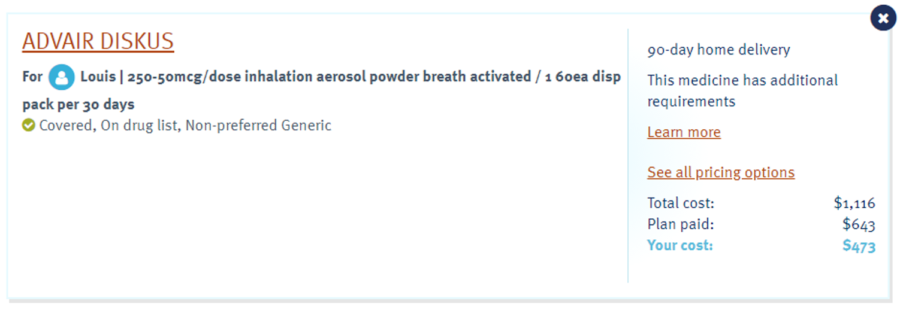

I no longer have the luxury of paying $20 and getting my medicine—which I now know lists for $455—and passing on whatever the ultimate cost is to my employer. With an HSA, these are my dollars I’m spending, so I tried to be a conscious consumer. My first stop under this new insurance scheme was Walgreens—because I’ve been going there for 20-plus years and the inertia runs deep in my bones.

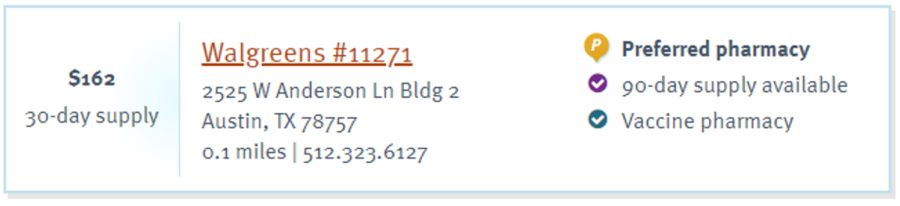

$162 seemed like a lot when compared to the old scheme—certainly Blue Cross could do better than that.

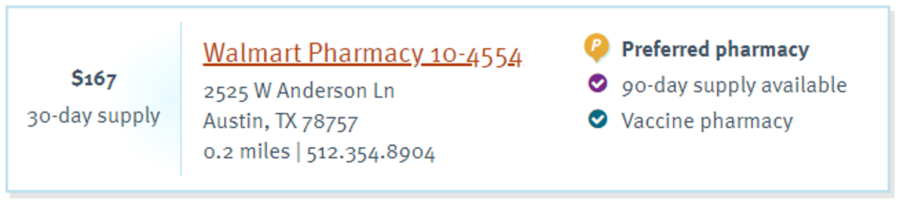

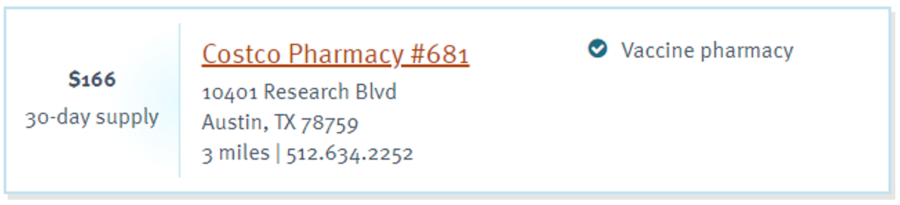

People always say that if you want cheaper meds, go to Walmart or a warehouse club. Odd, but they hovered right around the same number and were actually higher than Walgreens.

There’s no free market at play here. The difference in price among the three is a relative pittance from the consumer standpoint.

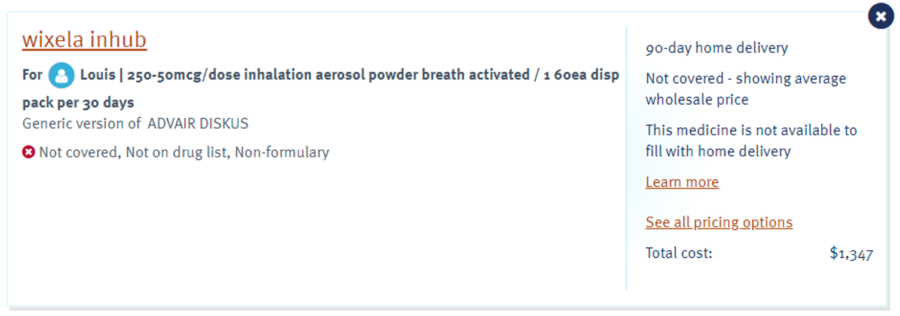

Undeterred, I called my doctor and asked for a new prescription flagged to allow for a generic. Surely generics are a sound investment and Blue Cross should be pleased with how I’m managing my benefit to lower the cost. Maybe they’ll even give me bonus points in their wellness program!

No. Blue Cross believes that they know better than my doctor what is appropriate for my treatment and won’t even cover the generic. This is getting weird.

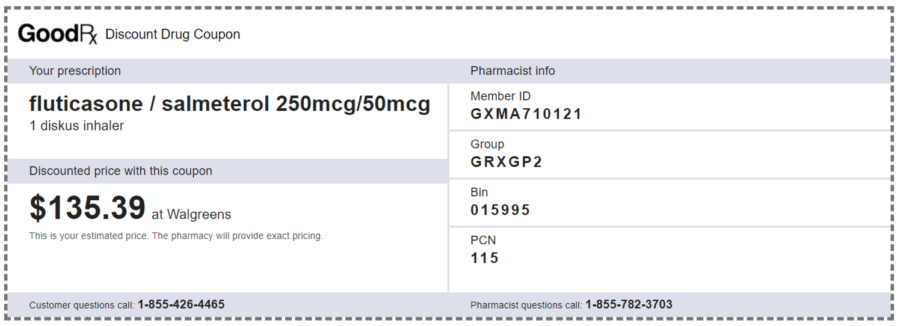

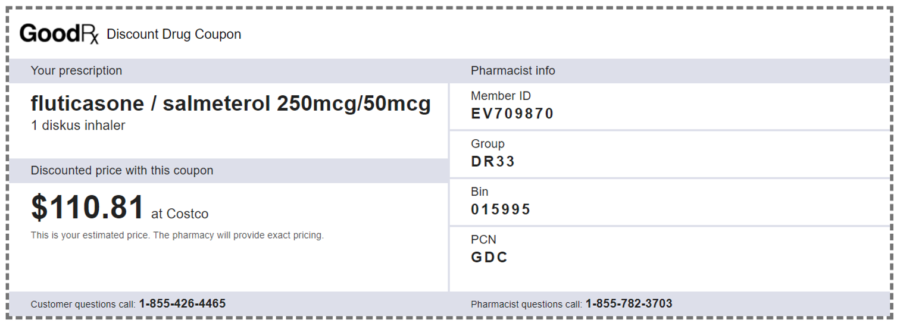

The Texas Public Policy Foundation, through its Right On Healthcare initiative, maintains a shopping list to help consumers save money on a variety of care items – which led me to GoodRx. Look at that—I can save $27 at Walgreens by choosing the generic or save $51 by getting it at Costco instead. The savings by going generic and choosing a different pharmacy is worth nearly 32 hot-dog combos!

So, there are savings to be had. Why wouldn’t Blue Cross want to save a few bucks for me, my employer and itself?

They own their Pharmacy Benefit Manager (PBM), Prime Therapeutics. PBMs operate as middlemen in the distribution channel for medications. They negotiate pricing on behalf of insurers with drug manufacturers and pharmacies and get a percentage of the cost in the form of a rebate from the drug manufacturer as their fee. The deals they negotiate determine which drugs are added to formulary lists (aka preferred) and which aren’t—impacting directly which drugs are covered by the insurer and your consumer copay.

In the case of my $455 Advair prescription, the price may be negotiated down to $200 and there still may be $100 or more of rebate money in play. A large portion is given to the insurer and the remainder remains in the PBM. The Blue Cross portion is used to reduce overall plan prescription costs and will mostly flow through to the ultimate insured in the form of lower premiums or out-of-pocket costs.

But, if Blue Cross owns its PBM, why push for 90% of the rebate money to be shared with the insured when 70% will do, retaining the remainder in its subsidiary with policyholders none the wiser?

Making matters worse is that PBM rebates from manufacturers are calculated as a percentage of manufacturer’s list price. This creates a perverse incentive for PBM’s to favor higher priced drugs—as is the case in nixing the Generic equivalent for Advair. The overall consideration they receive nets higher and the increased drug costs are borne by the market.

I need to point out that I’m riding Blue Cross pretty hard here—because they’ve been my insurer in one way or another since I was in diapers. But every major insurer has a PBM in its portfolio as a means to maximize profits in this manner. UnitedHealth owns OptumRx; Aetna merged with CVS Health; Cigna tied up with Express Scripts.

And there is little to no transparency about these relationships. This is a key failing in the Affordable Care Act (Obamacare). The ACA required that insurers return excess premiums collected to their policyholders based on claims paid. By simply receiving less in rebates from its own PBM, the health insurance provider shows a lower profit while the company as a whole continues to do better.

You can see the bargaining power difference with an independent PBM by looking at GoodRx pricing on the generic. Walgreens has clearly negotiated better terms for itself than Costco (or Costco chooses to accept a lower margin in its pharmacy unit). GoodRx still negotiates rates and rebates with the pharmacy and manufacturer, but has no insurer to cut in. So it keeps a more modest cut to generate the savings we see at the pharmacy through higher rebate sharing. Acting essentially as an online coupon provider, their overhead remains low. I wish I’d thought of this as an investment opportunity 10 years ago.

By contrast, insurer-owned PBMs use their leverage to dictate pricing to pharmacies, which is why the cost of the Advair is virtually the same regardless of pharmacy. This also explains the ongoing spat between Blue Cross and the CVS Pharmacy network, depriving consumers of choices in many smaller communities.

So Blue Cross definitely doesn’t want me to use the generic and/or a GoodRx coupon for one reason—the net rebate dollars coming in exceed the savings I can achieve as the insured. To drive home this point, that high deductible health plan—that we think caps our expenses at a certain number for the year—doesn’t include my out of pocket pharmacy costs unless they’re processed as Blue Cross claims.

So my choice is to pay $1,944 out of pocket for Blue Cross to manage the claim or save $612 a year going to Costco ($1,332), but get no credit toward my annual deductible.

Some choice.