States with a lower tax burden, such as Arizona, Florida, Nevada and Texas, created private sector jobs at almost double the rate of their high tax peers in the first nine months of the year, according to new government data.

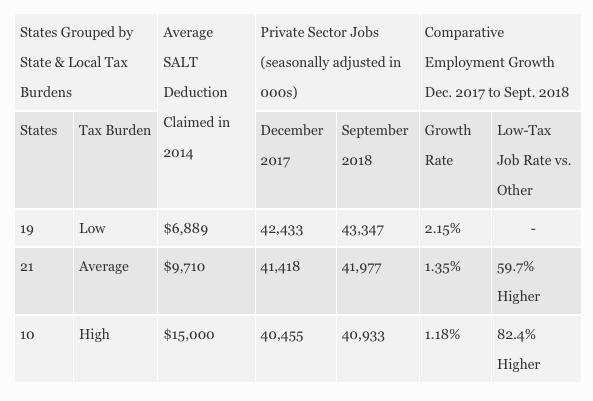

The U.S. Bureau of Labor Statistics published its monthly state-level jobs report last Friday, detailing the nation’s employment picture through September. The data confirms a trend that first emerged in the first quarter of 2018 where states that have a relatively low state and local tax burden have posted a rate of private sector job growth that’s 82.4% higher than that of high tax states. The job growth disparity has remained over nine months of data.

Measuring the average itemized deduction taxpayers filed for state and local taxes (SALT) in 2014, states can be broken out into three groups: 19 low-tax states led by Texas and Florida with 43.3 million private sector employees in September where the SALT deductions averaged $6,889; 21 average-tax states, Pennsylvania and Ohio being the most populous, with 42 million private sector employees taking average SALT deductions of $9,710; and 10 high-tax states, California, New York and Illinois being the largest, with 40.9 million people working in the private sector and an average SALT deduction of $15,000.

Significantly, for high income taxpayers in the 10 high-tax states with 40.9 million private sector workers, the difference in the taxes they pay to remain a resident of a high-tax state compared to what they could save by moving to a low tax state are now far larger, thanks to the federal tax code reducing the subsidy of high state and local taxes. Thus, the change in the federal tax code effectively changed the relative tax burden in all 50 states, with low-tax taxes seeing their comparative advantage in taxes grow due to the SALT deduction limitation.

With their high-end taxpayers — and frequently, political donors — now on the hook for a larger share of their state and local taxes, high-tax state attorneys general filed a federal lawsuit last July to overturn the $10,000 SALT deduction cap. The lawsuit, largely for show, will likely fail.

Further examining private sector job growth among the states, the data shows that in the 18 months before the December 2017 Trump tax cut, semi-annual private sector job growth averaged 0.86% in the high-tax states compared to 1.07% in the low-tax states, a difference of only 30% in favor of the low-tax states.

After the tax cut and its limitation on SALT deductions, that job creation gap has more than doubled as job-creating investment capital likely flowed to lower tax jurisdictions where higher after-tax profits could be realized.

Some critics of this conclusion (made by the author in past columns as the job growth rate disparity became apparent) have cited the rising price of oil as the reason for the higher rate of growth in low-tax states. But the individual state-level employment numbers tend to disprove that notion.

Texas does have the third-highest rate of private sector job growth in the nation over the period, at 2.78%, behind Arizona at 3.17% and North Dakota, 2.87%. Texas has about 311,000 producing oil and gas wells while North Dakota has a little more than 14,000. Arizona has 16. California even has around 53,000 oil and gas wells and would have more, were it not for state policy that has actively discouraged production for decades. Utah posted the fourth-highest rate of job growth in the nation at 2.72% in the period December 2017 to September 2018.

Furthermore, the oil and gas industry is capital-intensive rather than labor-intensive, with only 2.5% of private sector jobs in Texas being in the mining and logging sector (of which oil and gas extraction is a subset). Even in North Dakota, with its smaller, less-diversified economy, mining and logging jobs are 5.9% of the total private sector workforce.

So, the higher rates of job growth in the low-tax states is not about the price of oil; it’s about lower taxes.