Think that a pronounced economic crisis has ushered in more cost-efficient local government? Think again!

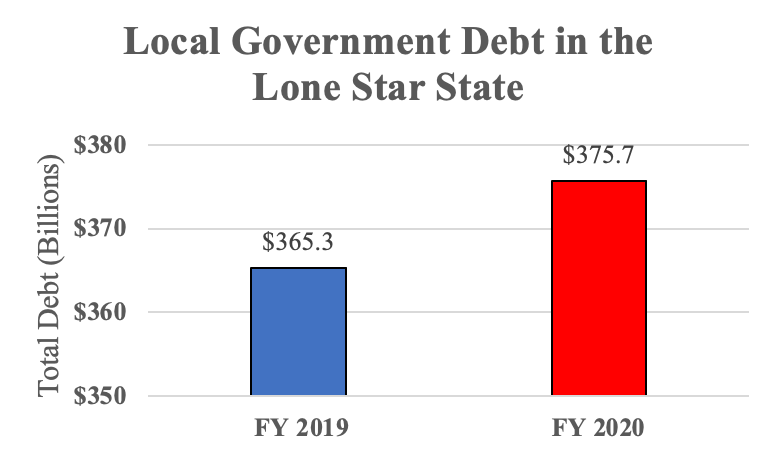

New data from the Bond Review Board shows that in 2020, total local debt rose to $375.7 billion, an increase of more than $10 billion over the previous fiscal year.

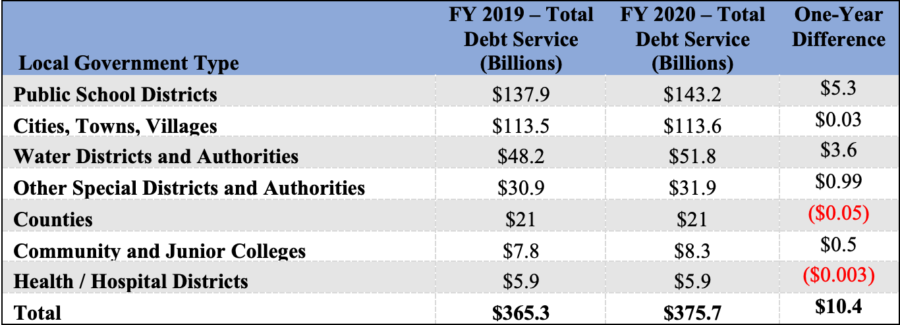

Source: obtained from Public Information Act request and Bond Review Report

The political subdivision responsible for the greatest year-over-year increase was public school districts. Their debt burden rose by a staggering $5.3 billion. That represents more than half of the total annual increase.

Other taxing entities that had a measurable one-year increase: water districts (+$3.6 billion) and other special districts (+$990 million). Two types of local governments—counties and hospital districts—went the other direction and experienced a modest decline in their overall debt loads.

Given the mammoth increase in school district debt—especially in relation to other taxing entities and in the context of a job-killing pandemic—it seems fitting to ask: What is driving school district debt? Why can’t these entities do more to stretch a dollar? Might it be time for an overhaul?

Source: Bond Review Board

Figures may not add due to rounding.