The Issue

Texas’s local governments are awash in red ink.

In fiscal year 2019, the principal amount owed by cities, counties, school districts, and special districts totaled $240 billion. That’s enough government debt to send a $8,220 bill to every man, woman, and child in Texas or saddle a family of four with $32,880.

Of course, this ocean of red ink is even greater when interest is taken into account.

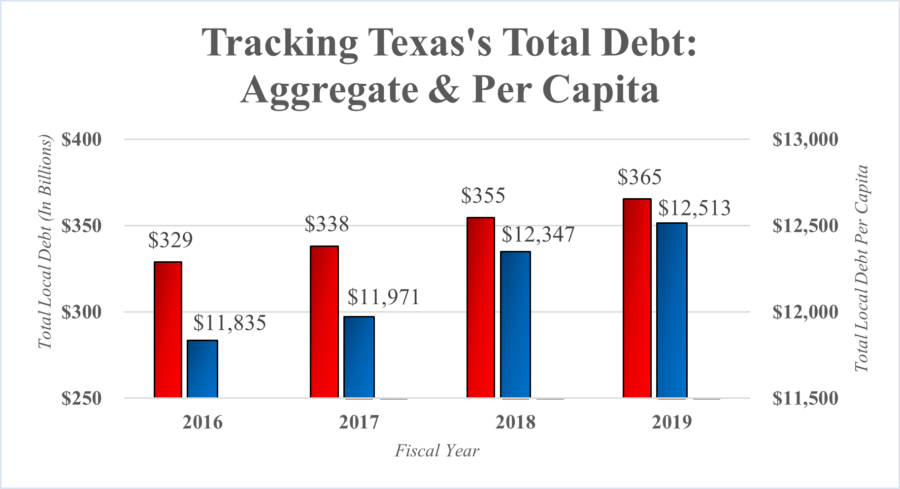

Texas’s total local debt burden—or the amount required to fully repay all of the principal and interest owed—stood at more than $365.3 billion in fiscal year 2019. On a per capita basis, that’s enough of an obligation to charge every Texan $12,513 or cost a family of four about $50,000.

Two types of governmental entities are most responsible for Texas’s debt load—school districts and cities. According to the Bond Review Board, school district debt totaled $137.9 billion or $25,390 owed per student, while city governments owed a combined $113.5 billion. Together, school district and city debt accounts for almost 70% of the overall total.

The size of local government debt presents policymakers with a major challenge. Left unchecked, the status quo promises to saddle future generations with enormous obligations, unleash higher taxes, slow economic growth and business investment, and trigger credit rating downgrades.

While there is no silver bullet solution, a number of reforms can help Texas localities get back on firmer footing, including:

- Expect Efficiency. During the last legislative session, state lawmakers passed a law requiring school districts seeking more tax money to first conduct an efficiency audit and publicly disclose the findings. In similar fashion, cities and counties should be required to periodically undergo a third-party efficiency audit of their budgets and operations. Any savings realized could be directed toward paying down debt or put aside for future capital improvement projects.

- Require Bond Elections to Be Held in November. Bond elections should be held on the November uniform election date so as to solicit the maximum number of voters and ensure that a small minority of special interests is not unduly influencing bond elections’ outcome.

- Establish Minimum Voter Turnout Requirements. Establish a minimum voter turnout threshold for the approval of new bond propositions and tax ratification elections. This too will help prevent the process from being dominated by a relatively small percentage of voters.

- Reform the Use of Certificates of Obligation. Certificates of Obligation (COs) are “an instrument of public debt made available to the governing bodies of cities, counties, and certain special districts. COs can be issued ‘without voter approval (unless a referendum is petitioned) and are backed by tax revenue, fee revenues or a combination of the two.’” These instruments have been abused and need reform aimed at:

- Achieving Greater Government Transparency. Require a lengthier notification period and make sure that the issuer has a website and that details related to the issuance are posted online in a timely manner.

- Making it Easier for Voters to Appeal. Reform the petition process so that 5% of the total number of voters that voted in the most recent gubernatorial election can compel a public vote.

- Using Tighter Restrictions. Because debt issuances are not approved by voters, the kind of capital improvement projects eligible to be funded with COs should be more tightly defined.

- Audit Regularly. A political subdivision’s use of bond proceeds should be audited on a regular basis by a major accounting firm until the funds are exhausted or all projects completed. Audits should be performed at least once a year.

These reforms as well as others promise to make important process changes that will bring about greater government transparency and accountability.

The Facts

- In fiscal 2019, local debt outstanding (principal only) was estimated at $240 billion, or approximately $8,220 owed per person.

- In fiscal 2019, local debt service outstanding (including principal and interest) was estimated at $365.3 billion, or approximately $12,500 owed per person.

- Among the top 10 most populous states, Texas’s local debt per capita ranks as the 2nd highest total, behind only New York.

Recommendations

- Reform the current local debt structure to require efficiency audits.

- Mandate that bond elections occur on the uniform election date in November.

- Establish minimum voter turnout requirements.

- Reform the use of certificates of obligation.

- Audit regularly.

Resource

Red Ink Rising in the Lone Star State: FY 2019 by James Quintero and Grace Watson, Texas Public Policy Foundation (March 2020).