The city of Killeen may soon hit homeowners with a double-digit tax increase.

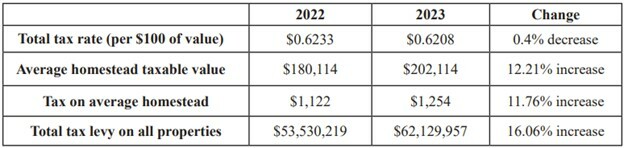

According to the city’s Notice of Public Hearing on Tax Increase, if the proposed tax rate is adopted, then the owner of an approximately $200,000 could see their city taxes rise from $1,122 per year to $1,254 per year. If it happens, that’ll mean the average homeowner pays about 12% more compared to the prior year. And, of course, it’s not just homeowners that could see their tax burden grow.

The city’s total tax burden (expressed as ‘Total tax levy on all properties’) is projected to rise by a whopping 16.1% in 2023. That burden will be borne by the entire community meaning businesses, renters, and other non-homesteaders should also expect their tax bills to grow. Worse, businesses may charge more for their goods and services to offset the increased cost of government, meaning homeowners and renters face the double-whammy of higher taxes and higher prices.

Source: Notice of Public Hearing on Tax Increase

What’s obvious from the data above is that Killeen officials aren’t considering a low enough tax rate to compensate for property value growth. The proposed tax rate is simply too high and its adoption is tantamount to raising taxes on everyone (the no-new-revenue tax rate is $0.5473 per $100).

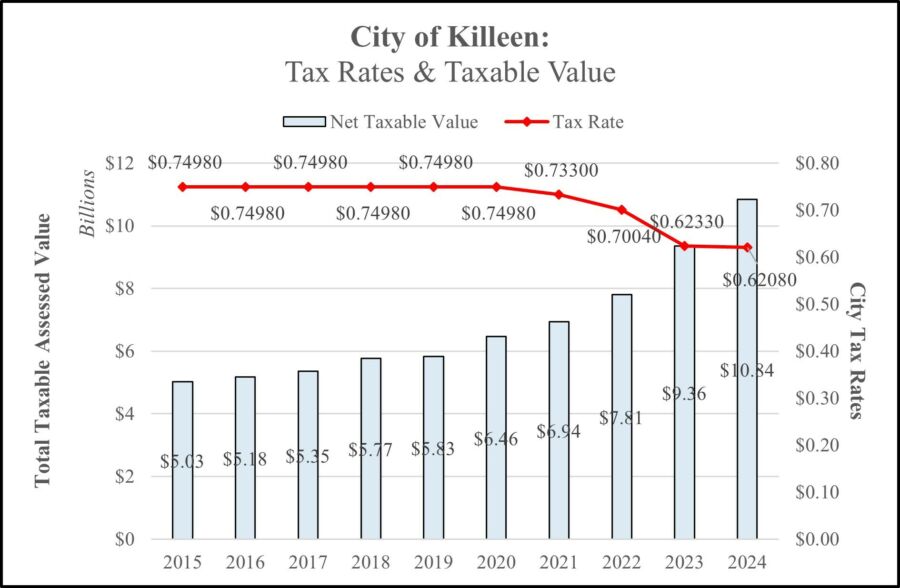

Unfortunately for taxpayers, this isn’t the first time that the city has seemed unwilling to properly align its tax rate with value growth. Consider that, from 2015 to 2024, net taxable value is projected to have increased by more than 115%. Over that same period, the city’s tax rate has only decreased by 17%. The combination of explosive value growth and minor rate decreases (which have really only occurred during the last few years) has produced a great deal more revenue for the city at the expense of the taxpaying public.

Source: City of Killeen’s Proposed Budget for FY 2024 (pg. 376)

Given these dynamics, let’s hope that city officials rethink their approach to the tax rate on Sept. 12 and decide to treat taxpayers a little better.