On Sept. 12, the Kerrville City Council is expected to meet and consider adopting a tax rate for the upcoming fiscal year. And if city hall decides to move forward with what’s been proposed, then the average homeowner could see an almost double-digit increase in city taxes.

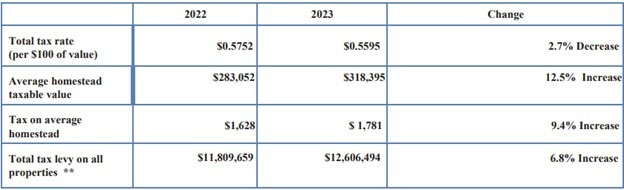

According to its Notice of Public Hearing on Tax Increase, Kerrville’s proposed tax rate for FY 2024 is $0.5595 per $100 of value, which is lower than the voter-approval tax rate ($0.5616 per $100 of property valuation) but higher than the no-new-revenue tax rate ($0.536 per $100). And while the proposed tax rate is a slight decrease from the prior year, it is not enough of a rate reduction to offset significant property value growth in the area. The result will mean higher taxes.

For the owner of a $320,000 home, the estimated annual tax increase in city taxes is more than $150 or a 9.4% hike. That nearly double-digit tax hike is a lot to ask from families today, especially given the soaring cost of food, gas, and clothing.

Source: Notice of Public Hearing on Tax Increase

Fortunately, there’s still time for members of the city council to consider adopting a much lower tax rate—preferably one at or below the no-new-revenue tax rate—and avoid adding to the cost-of-living crisis gripping many Texans. But it’s yet to be seen whether there’s enough of a political appetite on the Kerrville city council to reject raising taxes.

Stay tuned.