Student loan forgiveness is a topic that isn’t going away. Progressives want all student loan debt forgiven, and the Biden administration has been trying to deliver. In fact, the Biden team has been the most aggressive administration on student loan forgiveness in history.

But it’s not clear to me whether the administration is winning or losing this fight. One the one hand, it just suffered a massive loss in the recent U.S. Supreme Court decision, which ruled that its crown-jewel student loan forgiveness plan was illegal. This loss also paves the way for future losses, as it establishes legal precedent that can be used against other forgiveness plans. On the other hand, the American Enterprise Institute’s Nat Malkus has been tracking the amount of student loan forgiveness—almost $350 billion has been forgiven since 2020, and around $282 billion of that was forgiven under the Biden administration (these are the totals from Malkus’ tool plus the recent announcement of another $39 billion in forgiven loans—see the eighth effort below).

Keeping track of all the administration’s student loan forgiveness efforts is a challenge even for someone who follows the topic, but here is a rundown of the main efforts and where each stands.

- Mass student loan forgiveness through the HEROES Act

This was the main effort, which would have forgiven $10,000 in debt for any borrower making less than $125,000 a year, and $20,000 if the borrower received a Pell grant while a student. It was projected to cost anywhere from $469 billion to $519 billion. The alleged authority for this policy was the 2003 HEROES act, which gave the secretary of education the ability to waive or modify loan provisions during a war or a national emergency to ensure that those affected (e.g., reservists called up during the Iraq and Afghanistan wars) were not made worse off.

This was such a blatant overstepping of authority that the main legal fight was over whether anyone had standing to bring a case. In order to sue to stop a policy, a litigant must have standing, which requires a concrete injury from said policy. Prior to the recent case, it wasn’t a forgone conclusion that opponents would have standing to sue. But the Supreme Court ruled that the state of Missouri had standing because a state instrumentality set up to process student loans is paid based on the number of borrowers. Forgiveness would reduce the number of borrowers, and therefore the payments received, providing a concrete injury to the agency and to Missouri. The court also ruled that massive student loan forgiveness would need to satisfy the major questions doctrine, which requires that policies with large political and economic implications have clear authorization in statute.

In addition to killing this loan forgiveness policy, the case also establishes a road map that can be used against many future loan forgiveness policies—namely, argue that Missouri has standing to sue and that the policy is likely to violate the major questions doctrine.

- Borrower defense to repayment

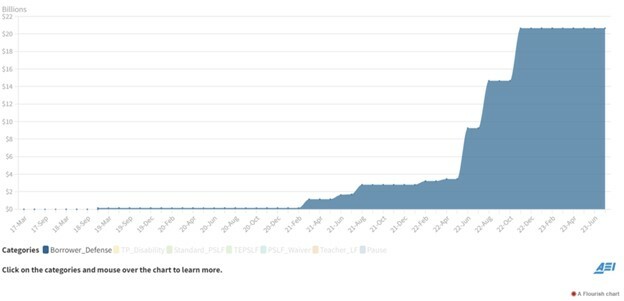

For years, borrower defense to repayment allowed borrowers to discharge some or all of their debt if they were victims of fraud on the part of the college. The Biden administration loosened these regulations, allowing for mass discharge, rather than treating each case individually, and expanding discharge when a college closed, among other measures. As this chart from Nat Malkus shows, the Biden administration’s changes dramatically increased the amount of debt forgiven under borrower defense to repayment from negligible amounts through 2020 to over $20 billion by 2023.

There are some legal actions against the borrower defense to repayment changes, but none are likely to reverse the bulk of the forgiveness that has occurred to date.

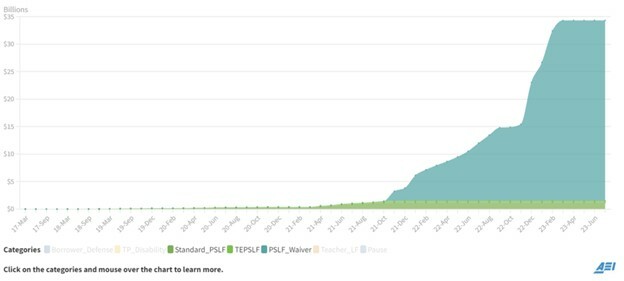

- Public Service Loan Forgiveness waivers and changes

The Public Service Loan Forgiveness (PSLF) program allows those working in government or most nonprofit organizations to have any remaining student loan balance forgiven after making 10 years of payments under an income-driven repayment plan. The Biden administration both loosened the requirements for the Temporary Expanded Public Service Loan Forgiveness program and offered waivers for the regular PSLF. Forgiveness under all these programs jumped to almost $35 billion by 2023.

There are no legal challenges to the changes made by the Biden administration.

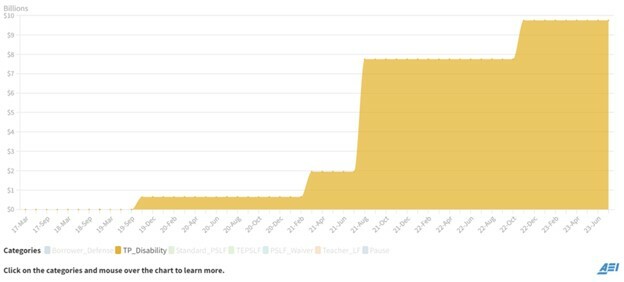

- Total and permanent disability

Students can also have their loans forgiven if they become totally and permanently disabled. This was very rare prior to Biden. But the Biden administration made it much easier, resulting in almost $10 billion in loans forgiven.

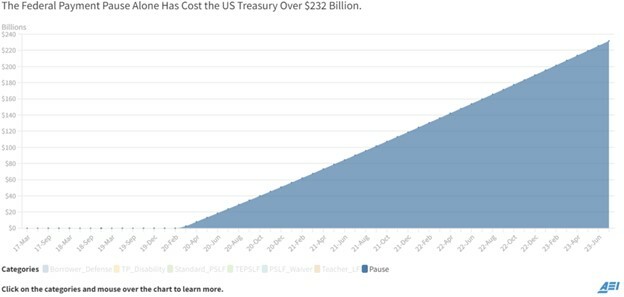

- Student loan repayment pause

As the country shut down in March 2020 due to COVID-19, student loan payments (and interest) were paused. Presidents Trump and Biden both extended the pause, such that most borrowers have not made a payment in over three years, including the entire Biden presidency. The Biden administration has repeatedly claimed that it would not extend the pause again, only to then extend the pause.

The cost of this pause is staggering—over $232 billion.

The student loan payment pause is supposed to end in August. Part of the recently passed reconciliation bill requires an end to the pause. But the Biden administration has announced yet another pause, although it pretends it isn’t a pause by calling it an “on-ramp.” From the announcement:

… the Department is creating a temporary “on-ramp” to protect borrowers from the harshest consequences of late, missed, or partial payments for up to 12 months. While payments will be due and interest will accrue during this period, interest will not capitalize at the end of the on-ramp period. Additionally, borrowers will not be reported to credit bureaus, be considered in default, or referred to collection agencies for late, missed, or partial payments during the on-ramp period.

Only with an Orwellian abuse of language can you claim that payments are still “due” if there are literally no consequences for missing payments. There is no difference between this and a payment pause. Restarting payments was one of the concessions that the Biden administration made to Republicans in the reconciliation bill, and now Biden has reneged on the deal. House Republicans should sue to make sure the law is implemented faithfully.

- New income-driven repayment plan

The Biden administration recently finalized the Saving on a Valuable Education (SAVE) repayment plan. The newly finalized regulations revise and rename the REPAYE program, dramatically reducing the amount students need to repay. Starting this summer, students earning less than 225% of the poverty line would owe nothing (previously, this was 150%), and any unpaid interest would be forgiven. Currently, a single person in the 48 contiguous states wouldn’t have to repay his loan until he earned $32,805 per year.

In 2024, the amount of income owed would be reduced from 10% to 5% for undergraduate loans, and borrowers who took out $12,000 or less would have their loans forgiven after 10 years of payments instead of 20.

The SAVE plan is projected to cost $475 billion over the next 10 years, which means that it would appear to run afoul of the major questions doctrine. However, it is not clear that a challenger would have standing to request a court-ordered injunction (when a court prevents the regulation from taking effect while the case proceeds). The accelerated forgiveness provisions would give Missouri standing to sue, but a court wouldn’t need to order an injunction until next year since the accelerated forgiveness provision doesn’t take effect until then. It also isn’t clear whether a court that overturns the accelerated forgiveness provisions would invalidate the rest of the changes. The best legal challenge may have to originate from the House of Representatives, which can specifically cite its power of the purse and the major questions doctrine. This is untested legal ground, but given that almost half a trillion dollars is at stake, House leadership shouldn’t hesitate to file a lawsuit.

- Mass student loan forgiveness through the Higher Education Act

After its recent Supreme Court loss, the Biden administration announced that it will try to implement mass student loan forgiveness under different statutory authority in the Higher Education Act. Fortunately, as Preston Cooper writes, this plan is likely to fail:

… the Higher Education Act requires the Department of Education to jump through several more legal hoops before any loans can be forgiven. The first step is a public hearing … After that will come a negotiated rulemaking process. Next, the Department will issue a proposed regulation detailing its debt-cancellation plan, which will be subject to public comment for at least 30 days. Then, the Department will issue a final rule and set an implementation date for the loan forgiveness. At this point, opponents of the program will invariably file their lawsuits, which will lead to further delays.

The end result will almost certainly be the same: The courts will strike down this backup loan-cancellation scheme. But the process is unlikely to resolve itself before the 2024 elections, which will allow President Biden to run for reelection as the loan-forgiveness candidate.

- Counting non-payments as payments

Income-driven repayment plans require students to pay a percentage of their incomes. If they do so for a number of years (ranging from 10 to 25 years), any remaining balance is forgiven. But the Biden administration just forgave another $39 billion for over 800,000 borrowers, in large part by counting partial payments as well as time spend in deferment or forbearance as time spent in repayment. This is absurd. The whole point of income-driven plans is to ensure that payments are always affordable. There should be no credit for partial payments because payment amounts already account for the borrower’s financial circumstances. If a borrower’s income goes down, so does his payment. If he didn’t make a payment, it wasn’t because he couldn’t afford it. Essentially, the Biden administration is treating payments as optional.

So, where does all this leave us regarding student loan forgiveness? I see two main takeaways.

First, Biden’s recklessness has made it harder for progressives to realize their goal of forgiving all debt. Because of Biden’s overreach in the HEROES Act plan, opponents now have a clear path to defeat many new student loan forgiveness efforts. They just need to establish standing to sue for Missouri and argue that the policy violates the major questions doctrine. It is highly unlikely that any universal loan forgiveness initiatives can survive these new challenges. Since mass student loan forgiveness is a terrible policy, this is great news.

Second, existing law allows for an astounding level of forgiveness. The waivers, loosened requirements, and temporary expansions have allowed the Biden administration to forgive a massive amount of debt. And the new SAVE repayment plan, unless struck down in court, will also result in massive forgiveness. Fiscally responsible legislators need to pursue all legal challenges to delay and prevent these policies from going into effect. Future Congresses need to explicitly leash the power of the secretary of education and stop writing such open-ended laws that progressives can try to exploit in their quest to forgive all debt.