Despite ongoing economic carnage (the fallout from the coronavirus pandemic), Dallas ISD appears poised to ask voters to support a mammoth $3.7 billion bond package—“the largest bond request by any type of taxing entity in Texas history.”

The district hopes to use these borrowed billions to build “[n]ew and more efficient security technology, 14 new replacement school buildings, 10 new facilities, renovated natatoriums and school-community hubs,” among other things. Administrators reason that now is the time to go deep into debt, with Dallas ISD’s superintendent saying: “It’s a great opportunity now… and the cost of interest rates being so low, here’s a great opportunity to get authorization–and we can adjust going forward.”

But while interest rates may indeed be low, there are a few reasons why now might not be the right time for a massive bond package.

First, the district is already deeply in debt. According to the Bond Review Board’s Searchable Debt Database, Dallas ISD’s debt totals more than $4 billion or a staggering $26,100 owed for every student enrolled. The district should focus on paying down its existing debt before asking voters to support putting more on the taxpayer credit card.

Second, any new issuance will put upon beleaguered taxpayers. While officials have said that “the district’s tax rate would not change because of the bond,” the fact is that there’s no such thing as a free lunch. By holding the tax rate steady (instead of lowering it as they should), officials will force a homeowner’s tax bill to go up because of soaring appraisals. Bigger tax bills are the last thing anyone needs right now.

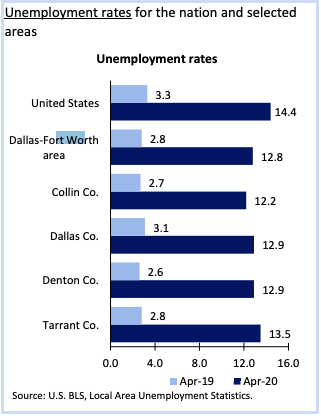

Lastly, the Metroplex economy is struggling. According to the Bureau of Labor Statistics, the unemployment rate in the Dallas-Fort Worth area was 12.8 percent as of April 2020. Joblessness in specific counties was: 12.2 percent in Collin County; 12.9 percent in Dallas County; 12.9 percent in Denton County; 13.5 percent in Tarrant County. These elevated unemployment rates suggest that the public isn’t in a position to take on new financial obligations.

Source: Bureau of Labor Statistics

Given all that’s unfolded in 2020, it’s clear that now is not the time for record-breaking bond packages or the bigger tax burdens that come along with them.