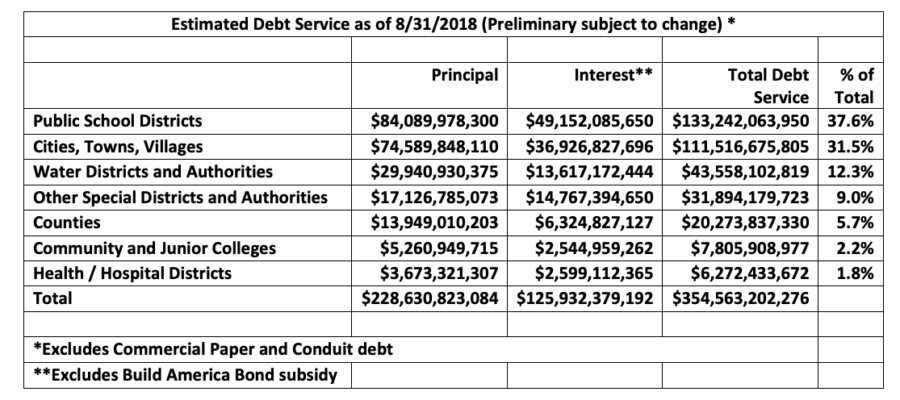

Answer: $354,563,202,276.

According to newly released figures from the Texas Bond Review Board, local government debt grew to a staggering $354.6 billion in fiscal year 2018. On a per capita basis, that’s enough public debt to swamp every man, woman, and child in Texas with more than $12,500 in red ink.

As in years past, school districts are the most heavily indebted type of local government. Of Texas’ $354.6 billion in total local debt, ISDs owe a combined $133.2 billion, which is equivalent to 37.6 percent of every dollar that must be repaid. City government debt follows closely behind, with $111.5 billion owed or 31.5 percent of the share. Special district debt totals $89.5 billion or 25.2 percent of the whole. And county government debt totals a more modest $20.3 billion or 5.7 percent.

This level of local government debt has many policy implications, i.e. higher taxes, bigger government, and slower economic growth, to name a few. Hence it’s worth asking: What can and should the next Texas Legislature do to begin getting a handle on the problem?

Here are a few ideas from the latest edition of the 2019-20 Legislator’s Guide to the Issues(pgs. 52-53).

- Informing Voters at the Ballot Box. Requireeach new bond proposition to include an estimate of the additional tax burden on the average homeowner resulting from its passage. This will give voters a better understanding of the cost of each new proposition.

- Maximizing Voter Participation. Change the law so that all elections with a fiscal impact are held on the November uniform election date. This will ensure maximum voter participation on issues affecting the family budget.

- Separating Big Ticket Items. Require that major capital improvement projects, above a certain cost or percentage threshold, be submitted to voters as separate propositions. This will eliminate the “all or nothing” approach seen today and allow for greater community customization.

- Ending “Rolling Polling.” Eliminate the practice of moving polling locations during the early voting period. Early voting locations should remain constant throughout an election cycle to avoid even the perception of impropriety.

- Encouraging Fairer Elections. Establish a minimum voter turnout threshold for the approval of new bond propositions or tax rate increases. This will prevent the process from being dominated by a relatively small percentage of voters.

- Restricting the Use of Unspent Bond Proceeds.Prohibit local governing bodies from using unspent bond proceeds on purposes and projects that were not specified at the time of voter approval. This will safeguard voters’ wishes and eliminate temptations.