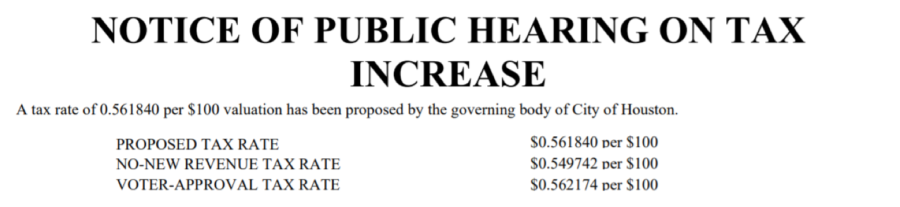

Today, the Houston City Council will consider adopting a property tax rate of $0.561840 per $100 of taxable value, which is very small decrease from the prior year but will still cause bills to grow given the appraisal increase. If adopted, the tax rate is expected to increase city taxes on the average homestead by $42 annually or 3.06%.

Source: City of Houston Notice of Public Hearing

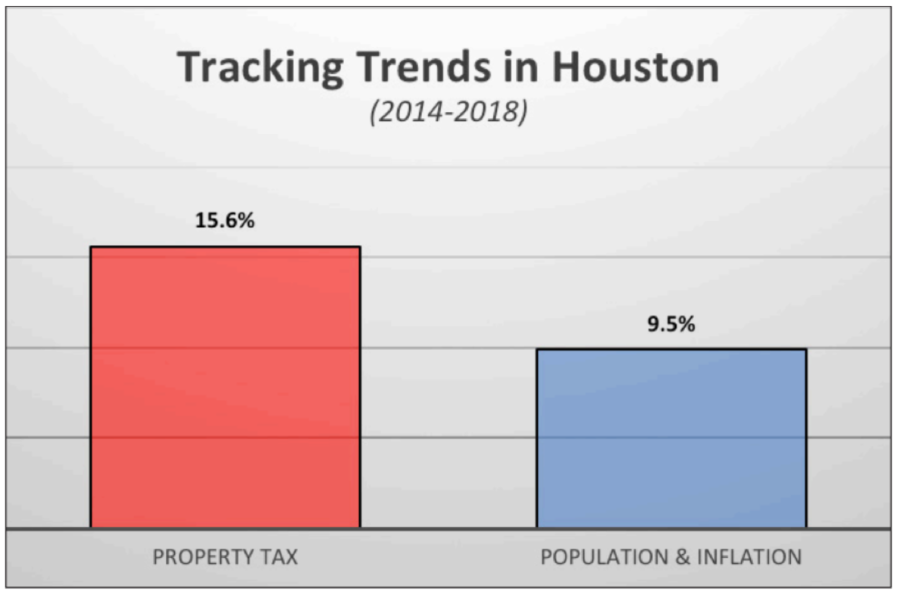

The push to raise taxes comes at a bad time too. Houston’s unemployment rate was 9.6% in September and countless bars, restaurants, and other businesses are “declaring bankruptcy or closing altogether. It’s also worth noting that Houston doesn’t need the new revenue. From 2014 to 2018, the city’s property tax levy grew at a faster clip than population and inflation.

Sources: Texas Local Bond Review Board, Texas Education Agency Student Enrollment Reports, and Bureau of Labor Statistics Consumer Price Index

With all of this in mind, city officials should weigh whether raising taxes by adopting the proposed tax rate is the right move, or if there is better alternative, like adopting the no-new-revenue tax rate.

Photo by Kelly Sikkema on Unsplash