Tarrant County residents could soon be the envy of taxpayers across the state.

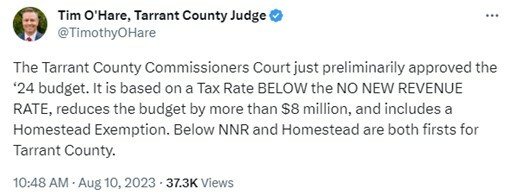

Last week, the county commissioners’ court gave its initial approval to the FY 2024 budget, and there was much to applaud. Here’s more from Tarrant County Tim O’Hare:

For those unfamiliar with the no-new-revenue (NNR) tax rate, it is “the tax rate that, if adopted, would produce the same amount of taxes if applied to the same properties from one year to the next.” By holding tax revenue constant, officials give property owners a chance to breathe a sigh of relief and either maintain their prior year’s tax burden or see it minimally reduced. But Tarrant County is positioning itself to go even further by adopting a rate that is less than the NNR tax rate. In all, commissioners are promising “a 13.17% cut in the tax rate, to 19.45 cents per $100 of a home’s appraised value.”

What’s more, the county also plans to reduce its budget by several million and taxpayers will benefit from a recently approved 10% homestead exemption. All in all, this means more money back in the pockets of property owners.

Overall, the court’s preliminary plans are exemplary and ought to inspire other counties to take a similar approach, lest they potentially lose residents to places like Tarrant County where small government, fiscal responsibility, and tax cuts are clear priorities.

Tarrant County: Keep up the good work.