The legislative session is right around the corner and many things are starting to become clear—like how big the budget should be, how much money will be available for property tax relief, and what top state officials are saying about it all. With that in mind, here are five critical policy questions and answers about budget and taxes that every Texan should know.

Question No. 1: What is the Conservative Texas Budget for 2024-25?

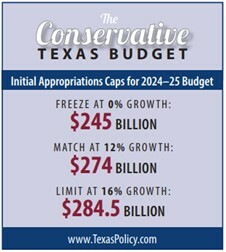

In December, the Foundation’s scholars published The 2024-25 Conservative Texas Budget which identifies three important measures: a budget held to no growth (0%); a budget held to historical population and inflation trends (12%); and a budget held to maximum population and inflation expectations (16%). At those percentage levels, the appropriation amounts are as follows:

Of course, from a limited government perspective, the most ideal option would be to allow for no new growth in the next state budget. Such austerity would demonstrate incredible fiscal discipline, control for new government growth, and make available a maximum amount of resources for tax relief purposes.

Falling short of that mark however, the next best option is to limit state spending growth to “the rates of population growth plus inflation since the 2004-05 budget.” This two-decade average yields a 12% threshold, causing the CTB maximum to be set at $274.4 billion. It’s important that we view this limit as a ceiling and not a floor.

Finally, historic inflation increases and modest population growth are projected to reach as much as 16% over the next two years. Technically, this provides policymakers with tremendous spending growth potential; however, this is the least ideal option since it would expand the size of government to uncomfortable levels, greatly reduce the opportunity for maximum tax relief, and potentially set the stage for a difficult 2025 legislative session.

Question No. 2: How Much is the General Revenue Surplus? Economic Stabilization Fund?

In July 2022, the Texas Comptroller of Public Accounts projected a $26.95 billion surplus in General Revenue-related funds by the end of fiscal year 2023. In November 2022, the Comptroller told a public gathering that: “…he expected Texas would have even more money available than the amount he originally forecast.” Yesterday, he again hinted at the same, saying: “…people will be shocked when I announce that the cash carryover balance in the treasury is greater than the $27 billion originally forecasted.” A more complete picture will emerge on Monday when the Comptroller provides the Legislature with its Biennial Revenue Estimate.

One factor which may diminish the surplus, at whichever amount is determined, is “any 2022-23 supplemental appropriations the Legislature may make.” No supplemental appropriations amount has yet been set; however, there are some indications that there may be a need for a Medicaid true-up ($3 – $5 billion?), House Bill 3-related tax compression overages ($5 billion?); and border security funding ($1 billion?).

In addition to the $27 billion General Revenue-related surplus, the Legislature can also expect a significant fund balance in the state’s Economic Stabilization Fund (ESF). In November 2022, the Comptroller reported that the ESF balance was projected to reach “about $14.1 billion” by the end of fiscal year 2023.

Question No. 3: What are the Expectations for Tax Relief?

State leadership has generally signaled that tax relief is a top priority.

For example, Texas Governor Greg Abbott has called for historic property tax relief on multiple occasions. Consider the following:

- In September 2022, Abbott called for the “largest property tax cut ever in the history of Texas.”

- In October 2022, Abbott said: “ Texas is sitting on a $27 Billion SURPLUS because of our record setting revenue. We will use much of it to deliver the largest property tax cut in Texas history.”

- In November 2022, Abbott said: “Texas is sitting on a $27 billion budget SURPLUS. I want to use at least HALF of that to deliver the LARGEST property tax cut in the history of our state!”

To deliver the largest property tax cut in Texas history, the Legislature will need to exceed the 2006 tax rate compression plan enacted that provided $14.2 billion in relief for the 2008-09 biennium.

In addition, Lt. Governor Dan Patrick has offered a multitude of tax relief ideas and said: “Our first priority is to send money back to the taxpayers of Texas.” Encouragingly, Patrick has also gone on the record to say: “When you have this kind of money you have to get it back to the taxpayer.”

Question No. 4: What Might Relief Look Like?

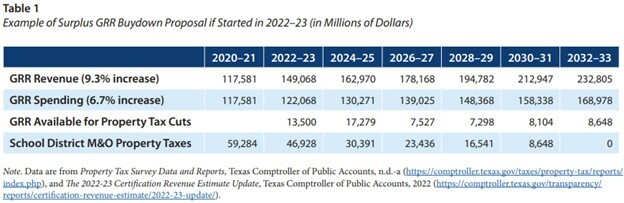

In the Foundation’s December 2022 research paper, Eliminating School District Maintenance and Operations Property Taxes, Dr. Vance Ginn and Dr. Daniel Sanchez-Pinol map out a 10-year buydown plan to gradually compress school districts’ maintenance and operations (M&O) tax rate to zero using only surplus funds. About the modeling, the scholars note: “By following this buydown approach and our estimates, the simulation shows that the state will have sufficient surplus funds to eliminate school district M&O property taxes and maintain the elimination while fully funding the state’s school finance formulas over the next decade. This includes reducing these property taxes by using half of the currently estimated $27 billion surplus for the 2022-23 biennium, as noted by Gov. Greg Abbott in September 2022, and then 90% of future general revenue-related surplus funds in each biennium thereafter…”

An excerpt from Drs. Ginn and Sanchez-Pinol’s research provides further detail about the plan:

It should be noted that tax rate compression is a superior approach to increasing the homestead exemption. The reason is that the former provides a pathway toward long-term structural reform—i.e. eliminating the ISD M&O tax rate—whereas the latter is more akin to a temporary tax relief mechanism.

Question No. 5: What Structural Reforms Can Be Made to Protect Any Tax Relief Realized in 2023?

Beyond tax rate compression, policymakers should be looking to make structural reforms that guard the gains made next session against erosion at the local level. Such reforms might include:

- Save Our Homes. Section 23(a) of the Tax Code establishes a limit on the amount of annual increase to the appraised value of a residence homestead. More specifically: “The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding year may not increase more than 10 percent per year.” In order to better protect homeownership and prevent people from being taxed out of their homes, the Legislature should consider reducing the limitation on residence homestead value increases to the lesser of 3% or the percentage change in the Consumer Price Index. Such a change would bring this aspect of Texas’ property tax appraisal system in line with Florida’s Save Our Homes Assessment Limitation, which was enacted as a constitutional change in 1995.

- True-Up the Threshold. Under current law, the voter-approval tax rate calculation excludes the value of new construction. The omission of this element creates an environment in which cities, counties, and certain special districts may collect more than the 3.5% limit would otherwise allow. The exact amount varies. The VATR calculation should be updated to include new property value in its tally, thereby observing SB’s intent in greater fashion.

- Lower the Limit. In 2019, the Legislature established two different standards governing property tax revenue growth—a 2.5% threshold for school districts and a 3.5% mark for cities, counties, and certain special districts. The differing standards add unnecessary confusion to an already complex system. The Legislature should consider lowering the 3.5% revenue limit for cities, counties, and special districts to 2.5% so that all political subdivision types are governed by the same, simple measure. Establishing one standard for all governmental entities will make the system easier to understand and engage with.

- Strengthen the Voter Information Document. Also in 2019, state lawmakers passed House Bill 477 which, among other things, created a Voter Information Document (VID). The VID is required for every bond proposition proposed by political subdivisions with more than 250 registered voters and it must contain the following information (per the House Research Organization):

- The language that would appear on the ballot;

- A table with the principal, estimated interest, and estimated combined principal and interest required for full payment of the proposed bonds and the principal, estimated interest, and estimated combined principal and interest required for full payment of all outstanding bonds as of the date the political subdivision adopted the debt obligation order;

- The estimated maximum annual increase in taxes that would be imposed on a residence homestead with an appraised value of $100,000, based on certain assumptions made by the governing body of the political subdivision detailed in the bill; and

- Any other information considered relevant or necessary to explain the other in the document.

Despite the attempt to increase debt transparency however, problems have emerged involving the information on the VID related to statistical manipulation, the use of rosy assumptions, and the nondisclosure of certain details. To remedy these issues and improve the VID’s effectiveness, the Legislature should amend state law to eliminate the arbitrary $100,000 appraised value estimate and replace it with the current year’s average taxable value for a residence homestead in the jurisdiction; force political subdivisions to disclose all underlying data; and require the VID to be prominently posted online either on the jurisdiction’s home page or on its bond election website, if it has one.

SEE HERE FOR 6 MORE TAX REFORM CONCEPTS.