The 86th Texas Legislature has started the session at full speed, much like the Texas economy that’s based partly on a thriving oil and gas industry.

In fact, oil and gas production continues to reach new heights. And with these new heights means more severance taxes into the state’s rainy day fund (technically the Economic Stabilization Fund).

But what should Texas do with the $15.4 billion that’s expected to be in the fund at the end of the upcoming 2020-21 budget? That’s easy: Lower the fund’s cap and use excess taxpayer money to lower taxes.

In the 1970s and ‘80s, the state was dependent on oil and gas for about one-fifth of the real private economy. So the wild swings in that industry contributed to wild swings in taxes and government spending. But politicians and those dependent on government provisions soon grew weary of these fluctuations.

After the steep oil market decline and subsequent economic recession in 1986, the Legislature decided in 1987 to provide a savings account that could help reduce this angst. The next year, Texas voters overwhelmingly approved the constitutional amendment that created a rainy day fund, for the specific purpose of being “used to offset unforeseen shortfalls in revenue,” as the ballot language noted.

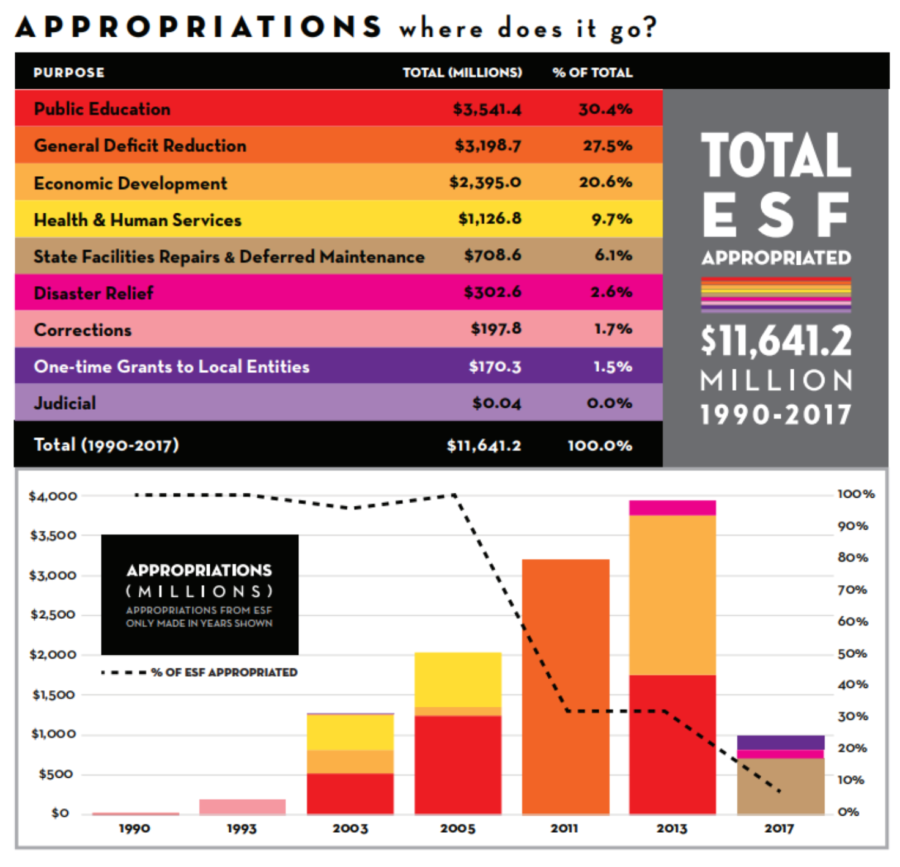

Funded predominantly by a portion of natural gas and oil production severance taxes, the fund also receives one-half of any surplus in general revenue. The amount in the fund has increased over time even as legislators have tapped it for many things. As the Legislative Budget Board’s figure below notes, the Legislature has appropriated $11.6 billion since 1990, which is 53 percent of the revenue deposited through 2018.

And two sessions ago the Legislature passed a bill and voters approved the constitutional amendment to dedicate half of new severance taxes to the fund to transportation, reducing the amount of the revenue stream and tying the hands of legislators.

The Foundation’s research explains issues related to the rainy day fund, including the following recommendations on how to reform it. We should:

- Increase the required vote to use the fund “at any time and for any purpose” to four-fifths of all members in both the Texas Senate and Texas House;

- Pass a constitutional amendment to lower the fund’s cap of 10 percent of certain biennial general revenue (GR) funds to 7 percent. (Research shows this would safeguard Texas from revenue instability by covering most, if not all, revenue shortfalls during the “most” severe recessions); and

- Require taxes above the fund’s cap, which go to GR today, provide tax relief, such as buying down the maintenance and operations school property tax.

However, another step that could essentially achieve the second recommendation without the high hurdle of a constitutional amendment is to exclude federal funds from the cap’s base by depositing those funds into another designated account—like they were before the rainy day fund was created. The LBB published a paper in 2016 showing how this would adjust the fund’s cap downward toward the Foundation’s 7 percent of GR recommendation.

With the current fund base, the 2020-21 biennial cap is $18.6 billion. The expected ESF balance, without any withdrawals this session, is $15.4 billion, or 83 percent of the limit. Excluding federal funds from the fund’s base, as suggested in Senate Bill 69 could drop the cap to about $13 billion, which is essentially the same as lowering the cap to 7 percent of certain GR-related funds.

By lowering the fund’s cap this way, there could be $2.4 billion of severance taxes above the cap. This is a large amount that would go in GR under current law for additional spending that would grow government. Instead of growing government by spending those excess dollars, that money should be put back in the productive private sector.

Other ideas have included creating a new endowment fund within the rainy day fund so that those dollars don’t lose purchasing power over time and using investment returns to pay down soaring unfunded state pension obligations and long-term infrastructure needs. While pensions are a major issue that must be addressed (especially the Teacher Retirement System (TRS) of Texas), spending more on pensions without key reforms will only kick the can down the road for a new day of reckoning from poorly designed defined-benefit plans.

So, what should be done with the potential $2.4 billion in excess money above the rainy day fund cap?

There’s a good chance that some of that will be used in a supplemental bill to cover unfunded 2018-19 expenditures, which are needed one-time disaster recovery efforts following Hurricane Harvey. This spending could reduce the amount of excess money available. But the state has an available fund balance at the end of 2019 of more than $4 billion that can be used to cover those unfunded amounts, leaving much, if not all, of the $2.4 billion for tax relief.

Specifically, this could be added to the amount of GR above a 4 percent increase in spending to go toward buying down the maintenance and operations school property tax. Collectively, this could put about $6 billion on the table for property tax relief this session. If this is tied to new laws slowing the growth of other property taxes (as in Senate Bill 2 and House Bill 2 propose), many Texans would see actual relief: a lower property tax bill. Over time, by using this package of mechanisms, legislators could cut nearly half of the property tax burden by eliminating the M&O school property tax completely.

The rainy day fund has too much money in it. Instead of spending those dollars or taking on greater risk with hard-earned taxpayer money, let people prosper by putting more money back into the pockets of families, so that the productive private sector can continue to flourish.