Even though there’s a pandemic happening, Dallas ISD is asking voters to support to a jaw-dropping $3.7 billion bond to fund campus improvements, new schools, and security and technology purchases. This request comes just five years after voters approved a $1.6 billion bond in 2015 for similar projects.

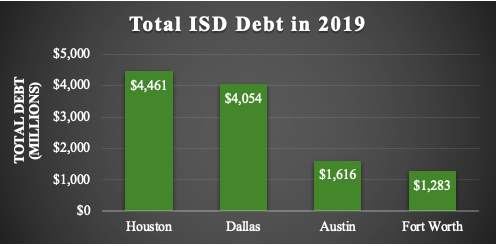

The sheer magnitude of the district’s proposed bond is shocking—but it’s even more so when considering how deeply in debt Dallas ISD already is. According to the Bond Review Board, Dallas ISD’s existing debt totaled a mammoth $4.1 billion in fiscal year 2019. On a per capita basis, the district owes more than $26,000 for each of its currently enrolled students.

Source: Texas Bond Review Board

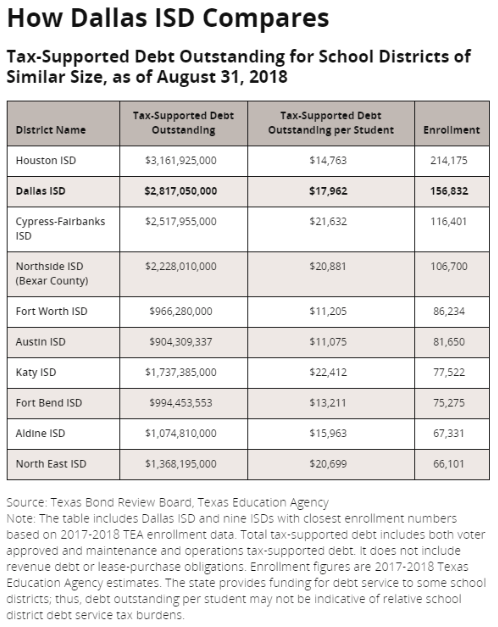

In comparison to its peers, the district’s borrowing is rather pronounced as well. Among other similarly-sized districts, Dallas ISD has the second-highest tax-supported debt outstanding and the fifth-highest tax-supported debt outstanding per student, according to the Texas Comptroller’s Debt at a Glance tool.

Again, these are debts that the district already owes. Effectively doubling that debt burden will truly move Dallas ISD’s finances in the wrong direction.