Texans are eager for massive property tax relief and policymakers appear ready to deliver. However, while there is broad agreement on the need for relief and the political will to see it through, there are competing visions on how to get it done.

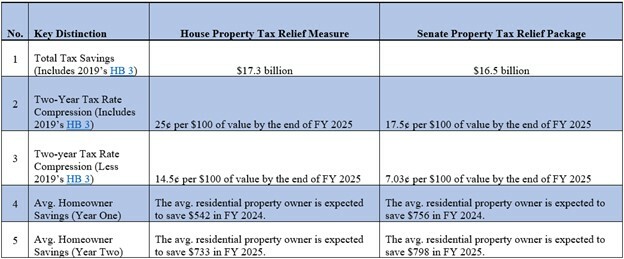

In the Texas House, lawmakers are supporting a plan that hinges on tax rate compression and the application of a 5% appraisal cap for all real property. In the Texas Senate, legislators are backing a plan that similarly includes tax rate compression but also features an increase in the homestead exemption and provides business focused tax relief.

To better appreciate how the two plans match up, consider some of the comparable features listed below.

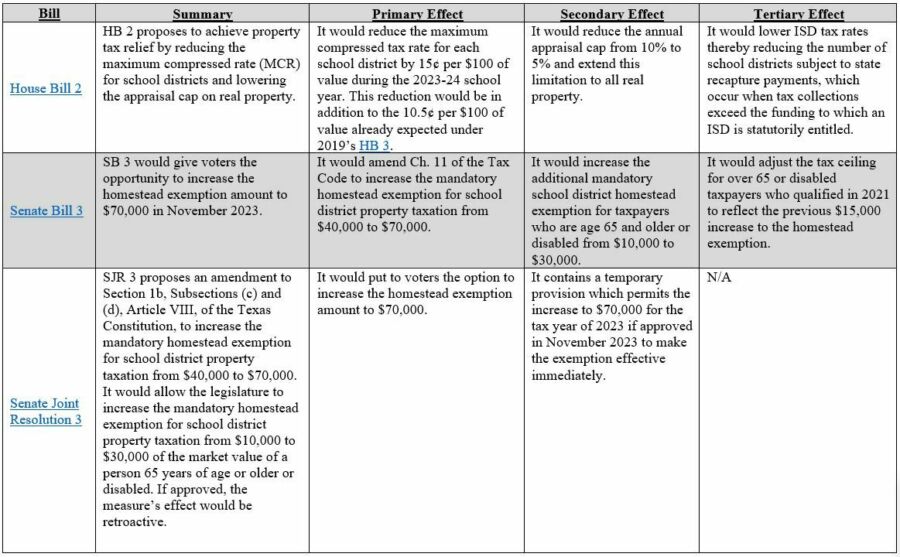

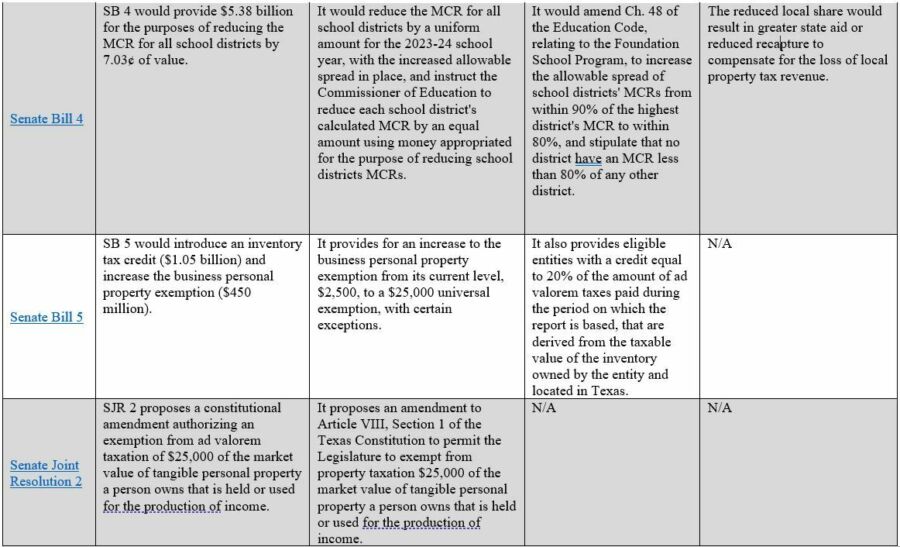

To delve even deeper into the mechanics of each chamber’s proposal, consider the following outline of the House’s plan (House Bill 2) and the Senate’s package (Senate Bills 3, 4, and 5 and Senate Joint Resolutions 2 and 3).