The city of Lubbock recently signaled that it may soon raise taxes, despite mounting economic and inflationary pressures on the family budget.

On Tuesday, KCBD reported that: “The city is considering a property tax rate increase of nearly one-and-a-half cents…That means residents would [sic] bay an additional $110 in property taxes next year.” A tax hike like this raises a question: Is it warranted? That is, have Lubbock’s revenues not kept pace with basic economic measures, like population and inflation, or is the city getting greedy?

Let’s find out.

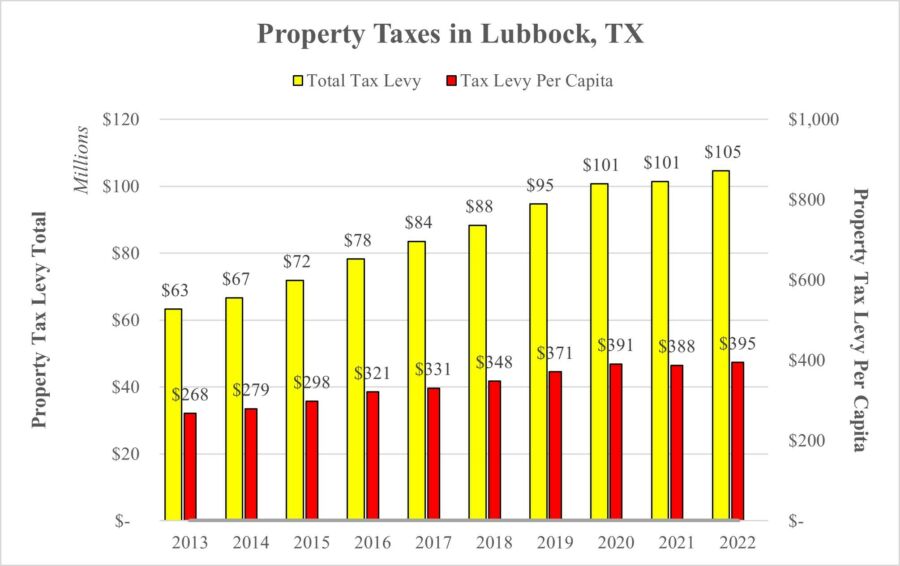

Using the city’s most recent Comprehensive Annual Financial Report (CAFR), we’re able to obtain audited data showing property tax levy growth over a 10-year period. Thus, from 2013 to 2022, Lubbock’s total tax levy (from pg. 186) increased from $63.3 million to $104.6 million, representing a jump of 65.3%. By dividing the total tax levy by the city’s population, we’re able to get a per capita estimate which shows that the tax levy burden grew from $268 per person to $395 per person over the same period.

Source: Fiscal Year 2022 Comprehensive Annual Financial Report

And how does that compare with population and inflation? Again, using data gleaned from the CAFR, we’re able to see that the city’s population (from pg. 189) grew from 236,362 in 2013 to 265,050 in 2022, representing a 12.1% increase. At the same time, inflation, as measured by the annual average change Consumer Price Index (U.S. city average, All Items), rose 25.6%. Thus, population and inflation combined increased by 37.7% whereas the city’s property tax grew 65.3%.

All of which strongly suggests that tax hikes aren’t needed in Hub City. And if anything, the city ought to be discussing reducing its tax rate substantially to make up for the excesses of the past.