Austin ISD’s student enrollment has been hemorrhaging for years. But that hasn’t stopped the uber-progressive district from spending every dollar it can gets its hands on nor does it appear to be standing in the way of a borrowing binge.

Earlier this week, Austin ISD announced that it was eyeing a big, new bond package that could cost more than $2 billion and raise taxes on struggling homeowners and businesses. Here’s more from KUT:

“The Austin Independent School District has released not one, but two, draft proposals for a 2022 bond. One package totals more than $1.55 billion and does not raise the tax rate. The other proposal is for roughly $2.18 billion and would require a 1 cent tax rate increase. AISD is collecting public input on both plans, but the board of trustees will ultimately decide which one, if either, will end up on the ballot in November.”

Don’t let tax rate language fool you. Leaving the tax rate alone or even increasing it by a small amount will cause tax bills to spike given how valuations are trending. According to the Travis Central Appraisal District: “on average, appraised values rose 56 percent over the past year.” In this type of environment, tax rates should coming down—and where they are not, your local officials are raising your taxes.

The tax rate issue aside, Austin ISD’s bond considerations are striking in another sense: Both packages propose to double the district’s debt outstanding.

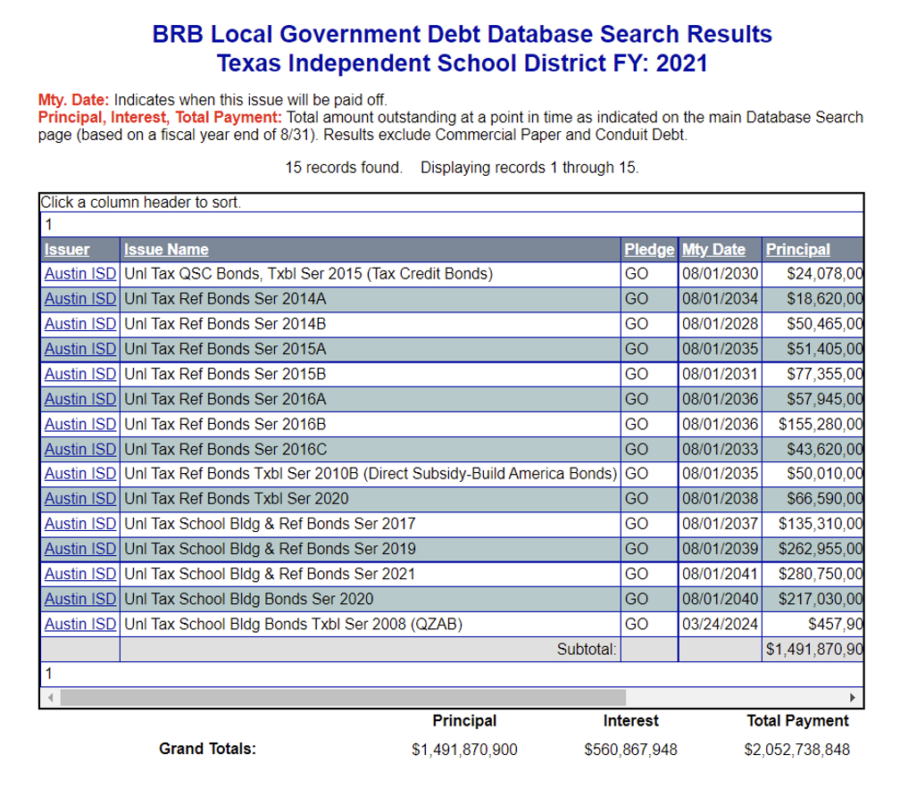

According to the Texas Bond Review Board’s Searchable Debt Database, Austin ISD’s principal outstanding in fiscal year (FY) 2021 totaled $1.49 billion. That figure is below the cost of both bond packages, i.e. $1.55 billion and $2.18 billion. It should be mentioned that none of these figures include interest costs which will further increase the price tag.

As it stands, the district appears willing to double its debt, assuming it can get voters to sign-off. That aggressive posture is troubling (even if it is consistent with historical budget trends—see pg. 20).

But now is not the time to entertain such fiscal extravagance. The economy stands on the verge of recession, inflation is costing the average U.S. household “an extra $341 a month,” and people are struggling to afford Austin. In fact, the New York Times recently named Austin “one of the least affordable cities in America.” If anything, now is the time for Austin ISD reset its operation to better contend with reality—that is, parents and students don’t want to attend the district for reasons of money, learning, and virtue. And because it has and will continue to teach fewer students, there is absolutely no reason why it should double its debt.