A recent Austin American-Staman investigation found that while the city of Austin is asking voters for a 20% tax rate hike in the upcoming November election, officials are also spending lavishly on privileged and personal expenses. For instance, the newspaper notes that the city’s newest adopted budget “raises council travel allotments by 55% and food budgets by 43% on top of a 4.5% bump to each member’s base office budget.” News of the city’s fattened travel, food, and discretionary budgets come on the heels of another spending controversy where Austin’s elite were recently caught splurging on steak dinners, business-class flights, and expensive retirement parties at taxpayer expense.

These latest episodes have many wondering about the city’s spending decisions and its long-term direction, both in terms of affordability and sustainability. One current city councilmember, who voted against the bloated budget and tax rate, put it this way: “I believe as our leadership here, we need to take a closer look at our expenditures (and) find smarter ways of managing public dollars.”

His criticism isn’t without merit either, as the data shows.

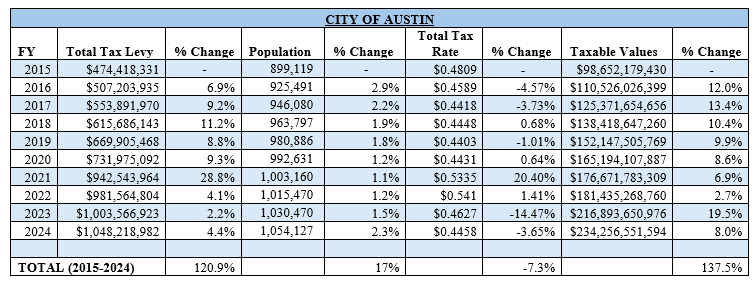

From 2015 to 2025, the city’s property tax levy exploded by 120.9% while its population increased just 17%, according to the city’s most recently published Annual Comprehensive Financial Report. This divergence was made possible by a combination of relatively stagnant tax rates (-7.3%) and skyrocketing property values (+137.5%). The city has near-total discretion over the first.

Source: Annual Comprehensive Financial Report for the fiscal year ended September 30, 2024

From a macro perspective, these historical data suggest a long pattern of taxpayer abuse, wherein city officials have placed far more emphasis on the government’s budget than the family’s budget. Considering this poor track record then, we should not be surprised by the Statesman’s recent findings nor should we expect that the city’s ongoing abuse will fix itself.

Instead, Austinites should use this moment to familiarize themselves with fiscal rules governing the growth of taxation and spending—like balanced budget requirements, local spending limits, stricter revenue limits, and more. The institution of one or more of these rules is one of the most effective and enduring ways to get at the root of this problem, and force city officials to do the one thing they’ve long resisted—control their appetite for Other People’s Money.