This commentary originally appeared in Forbes on July 22, 2015.

Thomas Piketty in “Capital in the Twenty-First Century” frets that wealth inequality will grow because capital’s share of income will grow faster than the economy. Thus, the 1 percent will be richer.

The New York Times’ Paul Krugman glowingly reviewed Piketty’s book, calling it “…a revolution in our understanding of long-term trends in inequality.” To be sure, Krugman had his complaints, writing, that Piketty’s “…failure to include deregulation is a significant disappointment.” Krugman concluded his review by citing Prof. Piketty’s call for global wealth taxes “to restrain the growing power of inherited wealth.”

Piketty’s view of the concentration of wealth and what should be done about it reinforces Krugman’s world view.

Matthew Rognlie, on the other hand, isn’t buying Piketty’s proposition. An M.I.T. doctoral student in economics, Rognlie contends in his “A note on Piketty and diminishing returns to capital,” published a year ago, that the French economist and academic failed to see that “Recent trends in both capital wealth and income are driven almost entirely by housing…” wryly suggesting Piketty’s famous book should have instead been entitled, “Housing in the Twenty-First Century.”

It’s one thing to claim, as Piketty does in front of a large amen chorus to the left, that the game of economics is rigged for the rich. It’s another thing entirely if Piketty’s thesis is founded, not on the high rate of return for capital, but merely the high rate of return for housing in the developed world.

Piketty’s contention generates a vastly different narrative, with satisfying calls for higher taxes on wealth. Piketty gives “Soak the rich!” a new lease as a rallying cry.

Rognlie’s retort is more problematic. If the accumulation of capital is really about equity inhomes, then the “problem” of wealth concentration is not an issue of the “1 percent,” rather, it’s an issue of homeowners vs. renters—a far more problematic proposition for elected officials.

And, why are housing values soaring? Rognlie’s notes two studies, one examining New York City and the other, California. These studies found that in “markets with high housing costs” those “costs are driven in large part by artificial scarcity through land use regulation.”

If true, this presents an interesting conundrum to policymakers. Should the issue of wealth accumulation through housing equity be addressed with a reinvigorated death tax, presumably at far lower threshold, say $100,000? Or, should the underlying reason for high housing costs, artificial scarcity, be addressed at the county and city level, where most land use decisions in America still reside, or, if that fails, at the state or federal level?

Compared to renters, homeowners tend to have higher income, are better educated, are older, and vote more frequently. Add to the potent mix, the fact that homeowners, by definition, are already established in their communities as opposed to the potentially new residents who can’t yet vote in a local election. As a result, homeowners have a powerful pull on elected officials when it comes to discouraging development on nearby properties. After all, it’s only enlightened self-interest when a homeowner, enjoying her slice of paradise, exercises political power to prevent newcomers from paving paradise to put up a parking lot.

Lawmakers create laws for specific purposes. But, like Dr. Frankenstein, their creatures, once animated and unleashed onto this world, often stray far from the intentions of their masters. Thus, land use restrictions, operating to protect the interest of homeowners, also act to artificially restrict the supply of new housing, driving up the cost of housing and of goods and services in general and compounding the ability of people to buy houses to begin accumulating capital themselves.

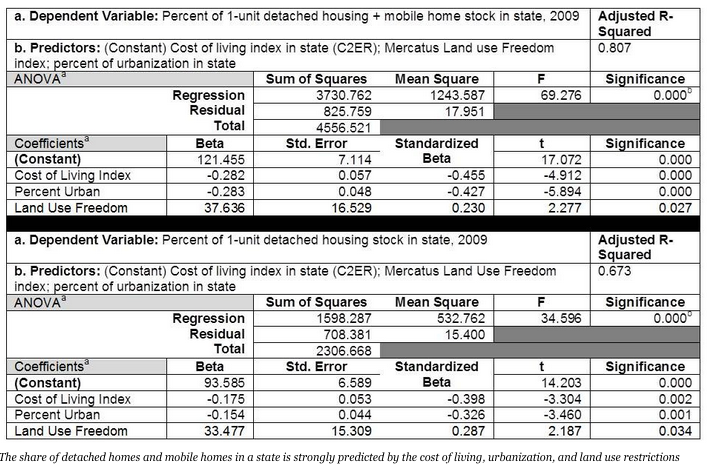

Using housing and urbanization data from the U.S. Census Bureau, cost of living data from the Council for Community and Economic Research, and a general measure of property rights at the state level developed by the Mercatus Center at George Mason University, we can test the proposition that cost of living is driven largely by high housing costs which are largely driven by land use restrictions.

When possible, Americans prefer to live in traditional single family detached homes. A 2012 National Association of Home Builders survey showed that 71 percent of potential homebuyers preferred a detached home. Yet, the percentage of homes as a share of the housing stock varies from a high of 73.5 percent in Iowa to a low of 41.7 percent in New York (it’s 12.1 percent in the District of Columbia). Apologists for heavy regulation of property rights will claim that urbanization drives both the cost living and the prevalence of single family homes. A multivariate regression analysis can test this.

The following two panels look at single family detached homes and mobile homes as a share of the housing stock in 50 states as well as single family detached homes alone and measure those against the significance of a state’s cost of living, the degree of urbanization and land use freedom. All three of these factors reliably predict the number of single family homes and mobile homes in a state, with higher costs and more urbanization predicting fewer houses and mobile homes and more land use freedom equating to more single family homes and mobile homes. It’s all fairly much common sense, but it is nice to see statistical reinforcement that notion.

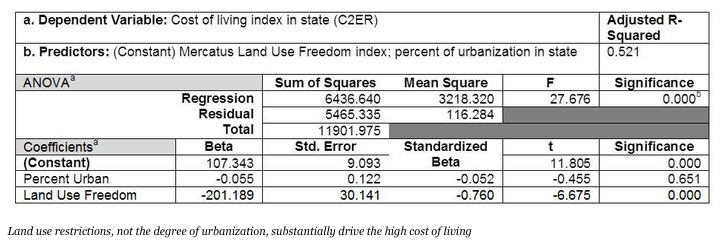

But, what about cost of living as the dependent variable? If the cost of living, the degree of urbanization and land use freedom had a big effect on housing in a state, what drives the cost of living, of which the greatest share of differences between the states is due to wide variances in the cost of housing? The panel below shows that land use freedom, not the degree of urbanization, can explain most of the variance in the cost of living from state-to-state.

The high cost of housing contributes to another worsening national trend: the rising poverty rate. The U.S. Census Bureau now maintains two poverty rates, the Official and the Supplemental. The traditional official poverty measure is more than a half-century old and doesn’t account for cost of living differences between the states nor does it count non-cash assistance such as food stamps or housing subsidies. The supplemental rate does account for state-level housing costs as well as the full array of government benefits given to the poor in addition to taxes and some work related expenses. The upshot: poverty is far worse than advertised in states with high costs of living, most of which is due to onerous property rights restrictions that make it very difficult to build affordable housing.

Randal O’Toole, a senior fellow with the Cato Institute, notes that houses in California, a state with the nation’s third-most-restrictive land use policies, after New Jersey and Maryland, has gotten “so expensive that no one can buy anything.”

O’Toole says that the median home value to median family income ratio reached 10 to 1 at the height of the housing boom in 2006 in the greater San Francisco Bay area vs. only 2 to 1 in Houston.

After plunging temporarily, California’s tough land use regulations (now compounded by greenhouse gas emission rules) have once again constricted supply of new housing, pushing the median home value to median family income ratio in the San Francisco Bay area back to 6.8 to 1 vs. a far more benign 2.2 to 1 ratio in Houston in 2013. Figures for 2014 and 2015, when published, are likely to see a return to the 10 to 1 home value to income levels in the Bay area.

O’Toole says, with only partial facetiousness, that average Californians will need 50-year mortgages or intergenerational loans to buy a house in the areas with the most economic opportunity.

O’Toole also cited a disturbing trend: areas with the highest land use restrictions were seeing a rapid outmigration of African-Americans, with San Francisco experiencing the nation’s biggest exodus as a share of population. Other areas that are losing black residents include New York, Los Angeles, Chicago, Honolulu, and just about every urban area in California except the Riverside-San Bernardino metro region. Austin, Texas, perennially the fastest-growing big city in America, is experiencing the nation’s second-steepest decline in the proportion of its black residents. Austin, an elite liberal city in a state otherwise in tune with economic liberty, is known for having some of the toughest land use restrictions in Texas.

Confirming this worrisome trend in Texas, Greg Abbott, the new governor, warned that the Lone Star State was being “Californiaized” by “…a patchwork quilt of bans and rules and regulations that are eroding the Texas model” with “Some cities… telling citizens you don’t own some of the things on your property…”

As mentioned, laws can take unexpected turns, becoming uncontrolled monsters. One unleashed monster, born of good intent, resides in California, where it was fashioned from a myriad of attempts to help low and fixed income people who live in mobile home parks. There, layer upon layer of state and local regulation has had the opposite effect.

“No one opens new mobile home parks in California,” said Sheila Dey, Executive Director ofWestern Manufactured Housing Communities Association. Opposition from local governments and the expense make it prohibitive to build new communities. She noted that 110 local California jurisdictions have some form of rent control for mobile home parks. “A brand new mobile home park hasn’t been built in California in decades,” she added, closing off new supply of one form of unsubsidized affordable housing.

According to industry sources, about 13,500 new manufactured homes will be sold in Texas this year vs. a projection of about 2,600 in California; less than one-fifth of Texas’ total in a state that’s 44 percent more populous.

According to the Census Bureau, almost 3.9 percent of California’s housing stock was in manufactured homes compared to 7.3 percent in Texas.

Mobile homes have traditionally housed the retired or working poor. But in California, as traditional homes have again spiked in cost due to restricted supply, manufactured home buyers are increasingly younger, wealthier, more educated, and have bigger families.

Sheila Dey’s counterpart in the Lone Star State, D.J. Pendleton of the Texas Manufactured Housing Association, says that mobile home parks aren’t regulated in Texas, making a count of new openings difficult to determine. He does note that many existing parks are being expanded.

As for more expensive single family detached homes, over the past year, Texas averaged 8,500 single family housing starts per month, a little more than the 7,280 housing starts per month it’s averaged since 1988. In the past year California averaged 3,308 single family housing starts per month, less than half that in Texas and less than half of its monthly average of 6,995 since 1988.

But, according to the U.S. Census, California is adding about 30,900 people per month accounting for births, deaths, international immigration and net domestic outmigration. But, it is only adding about one single family detached home for every nine new arrivals. In the past year, California home builders have made room for about 106,000 people in single family detached homes, leaving 266,000 to search for other options. As this trend continues, Californians will increasingly find themselves in apartments and condominiums, whether they want to be or not.

Texas, the second-most-populous state, is adding about 37,600 people per month and building homes on a pace to accommodate about 275,000 people per year with about 176,000 people having to opt for something other than the ideal of a single family detached home.

Tom Grable, Division President of TRI Pointe Homes Southern California, a national homebuilding company, says getting approval to build in California can be, “Vastly different than in other states,” with regulatory approval timelines that can stretch out for years.

California’s bureaucratic maze of approvals add cost and uncertainty to builders who are then pressed to sell homes for more than a million dollars that in Texas might fetch $300,000.

This high cost for housing reinforces an accelerating national trend: the decline in marriage. As one national real estate consultant said, “You don’t need a detached home if you’re delaying marriage and not having children.”

Breaking down barriers to building homes will likely result in: a reduction in prices for new homes; a decrease in the cost of living; a reduction in the supplemental poverty rate; and an improvement in quality of life that may encourage higher rates of family formation.

Returning to Rognlie one last time, an additional major critique he has of Piketty is Piketty’s contention that labor will be easier to replace with capital than has historically been the case. This theory is important to Piketty’s case that people with capital will experience greater benefits than that seen by labor.

Rognlie’s retort to Piketty may operate in truly free markets where labor has mobility to meet demands. But, as is often the case with government meddling in the economy, unintended consequences arise, distorting markets.

For instance, persistently high unemployment and poverty levels in Los Angeles might, in a free market for labor, cause some people to either reduce their wage demands to get a job or move to a location where their labor can command a higher premium. But, in the this age of welfare, housing subsidies and the minimum wage, the unemployed are less likely to move for work. This is compounded by proposal to increase the minimum wage in Los Angeles to $15 an hour, pricing large numbers of marginally-skilled people out of the workforce and simultaneously inviting investment in capital to replace the labor that’s been artificially overpriced by government decree.

If Piketty is right about the ease of substituting capital for labor in the coming years, it will be for the wrong reason— government action to “help” the poor may actually stimulate the rise of the robots Piketty himself fears .

Chuck DeVore is Vice President of National Initiatives at the Texas Public Policy Foundation. He was a California Assemblyman and is a Lt. Colonel in the U.S. Army Retired Reserve.